To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

First off, I want to set something straight. I do have money in speculative stocks. I don’t believe I can properly inform and educate someone unless I have experiences specific to that topic. I wouldn’t attempt to teach you about time travel because I haven’t done it and have no experience with it — but if I did I would most certainly pass on the hottest stocks. Maybe I’ll save that for a future article…

The key word being experience. With reviewing a book, I am passing along a very brief summary of the information contained in the book but I’d still leave it up to the book to teach you about its content. As much as I could learn about a topic through books, I believe the best way to learn is by doing it ourselves and learning through personal experiences. Everyone learns in different ways but I believe that applies to more people than not.

So although I do believe that investing through index funds would be the best option for most people (diversified, simple, attractive returns) I want to know what I’m talking about, not just through reading other people’s opinions but through creating my own based off of my own experiences. It does seem counter productive (to expose my money to unnecessary risk), but I look at it like paying for education. It is not very different than paying to go to university to learn about investing, in fact this is probably a much better way, and at the very least I won’t graduate with debt, at worst just with no money.

Throughout this article a thought may come into your head “why am I reading this, this guy hasn’t made it rich through investing?” — and that’s a totally fair point. I wouldn’t take anything I say without your own research and examination. I have made a lot of mistakes with investing, made bad trades and have lost money, out of the dozens of companies I’ve bought and sold I’ve probably only played a handful correctly. The point of this project is to help others avoid the mistakes I’ve read about and more importantly that I’ve made. By no means am I an expert on anything that I talk about, but the things I talk about are an honest insight into what I’ve learned, what I understand and what I’ve done.

So let’s get started. If not done properly and carefully, investing might as well be called ‘How to Lose a Portfolio in 10 Days’. Even though everything works out for Kate Hudson in the end (although against her original intention), investing isn’t a fairytale. That’s a fairly intimidating start for this article, I don’t mean to give you the impression that you’ll lose all of your money and investing is a terrible thing, because it’s not.

Like anything else, there are risks, uncertainties and ways to do it more effectively. In the past I’ve asked my sisters to cut my hair (wouldn’t recommend it), but I wouldn’t ask them to remove a cavity. We all have different assessments and definitions of risk, some people are willing to tolerate more than others. But I think there is a difference between being risky and reckless when it comes to our investment strategies. And the easiest way to eliminate that recklessness is to understand how we are investing our money and to evaluate if it is really worth it to us.

What are the differences between investing and speculation?

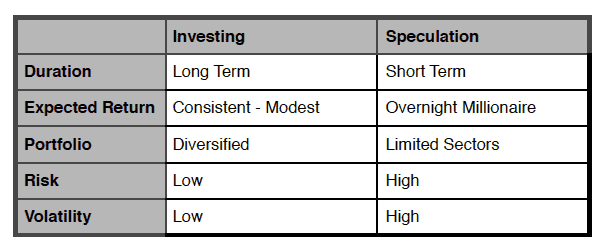

There’s a few major differences between investing and speculation that we will take a look at, they are: duration, expected return, portfolio, risk and volatility. Investing consists of diversified low risk portfolios with modest returns over a lifetime. Speculation is more of the ‘get rich quick’, it’s high risk portfolios usually specific to a sector (the next ‘big thing’ — tech, crypto, marijuana, etc.) with the hope of overnight riches. These differences are summarized in the table below.

With speculation investing you’re mostly dealing with ‘Penny Stocks’. Contrary to the name, a penny stock is anything that trades below a $5/share price (according to the U.S. Securities and Exchange Commission). Within penny stocks, you will find that there is high volatility (change in price day by day, hour by hour or even minute by minute). When I started investing I caught the end of the bubble before 2018. After five weeks of investing my portfolio was up 93%. There was a morning where I was up $4,000 before I even got into work and on the other end there’s been days or weeks where I’ve been down up to a couple thousand dollars. Looking back now, I’d say I was nothing but lucky during that time.

Never speculate on stocks with money you need to depend on. Yes, you’ll hear success stories about people getting rich from stocks, but it is very rare. Most of the time I would have to conclude that it is pure innocent luck. Whatever your speculative portfolio budget, before you invest it ask yourself if you’d be okay if you lost it all, does it have any immediate financial impact. I would say that speculative investing in the stock market is very similar to gambling. In speculative investing (gambling) you can pick your sector (game) and then your company (lucky seat). You don’t have an impact really on the outcome, you’re just there to observe and be subject to what the result is.

Let’s take a look at an example of how bad decisions can impact your portfolio for some time. If you put $10,000 and lost $2,000 of that due to bad investments and strategy, that’s a loss of 20%. In order to turn your now $8,000 into your original amount of $10,000 you need a 25% increase. If you had lost 50% ($5,000) you’d need a 100% increase or to double your money to return to your original amount. The point being, the more you lose, the more ground you have to make up to get back to where you were. It puts emphasis on how important it is to make good investment decisions and to protect your money within those investments.

Something that I’ve come across is the ‘Rule of 72’, take 72 and divide it by an annual rate of return and that’ll give you an approximate to how long it’ll take your money to double. 72 / 10 (% annual rate of return) = 7.2 years to double your money. Being careless with your investments could have financial impact for years to make that money back.

Your portfolio results can give you a false sense of your investing ability. If all of your stocks are going up you feel like a genius, you think ‘this is so easy, I should’ve started years ago, why doesn’t everyone do this?’. When your stocks are falling you feel terrible, it can ruin your entire day or week and you question every decision you ever made that brought you to this point. It really is one of the most complex love/hate relationships you can encounter. Make me rich, or leave me broke. Because of their nature, speculation stocks can be extremely stressful and honestly drive you crazy. You feel compelled to consistently check prices throughout the day, hoping each time you check that the number is green.

You Might Also Enjoy:

I’m not here to tell you how to invest your money, I just want to shed light on what options are out there and what I’ve experienced myself. I wouldn’t say that I am a great investor by any means, but I think what I’ve learned through my investing journey can benefit others by helping them become smarter investors to hopefully avoid some of the mistakes I’ve made. If you’re an efficient speculative investor, that’s great and a part of me wishes I was. If you’ve caught wind of some hot new stock and have been told to invest, I’d suggest doing your own research before making a decision. If you want someone else to completely manage your money, then hopefully this reinforces that idea for you.

About the Author

Derek Condon, CFP®

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor