Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

My personal experience agrees with Fed data…

We’ve been building our wealth for three decades now.

Starting from a negative net worth in 1992, we could now stop working (if we lowered our standard of living from great to merely good). My projections show we should reach work-optional status at our current standard of living or better in a few more years.

What Assets Have I Used?

Over these three decades, I’ve invested in:

- Individual stocks

- Stock, balanced, and bond mutual funds

- Residential and commercial real estate

I’ve never invested in:

- Crypto (seems like gambling on the “greater fool theory”)

- Individual bonds (too much trouble for too little gain)

- CDs (even lower gain and locks up your cash)

So, which works better, real estate or stocks? The following is the general result, followed by my personal experience…

In General, Which Gives the Higher Return — Real Estate or Stocks?

Using Yahoo Finance’s data on the total return of the S&P 500 from 1970 to date, we see a remarkable average annualized return of 16.6%. Adjusting for the 7.86-fold inflation over that time, the average annualized real return was 12.2%.

For real estate, we can look at Yale economist Robert Shiller’s data on US residential home prices. For the same period, the data show an average annual nominal return of 5.24%.

Correcting for inflation, that drops to just 1.2%.

Comparing the two, the S&P 500 comes out 10.8% a year ahead!

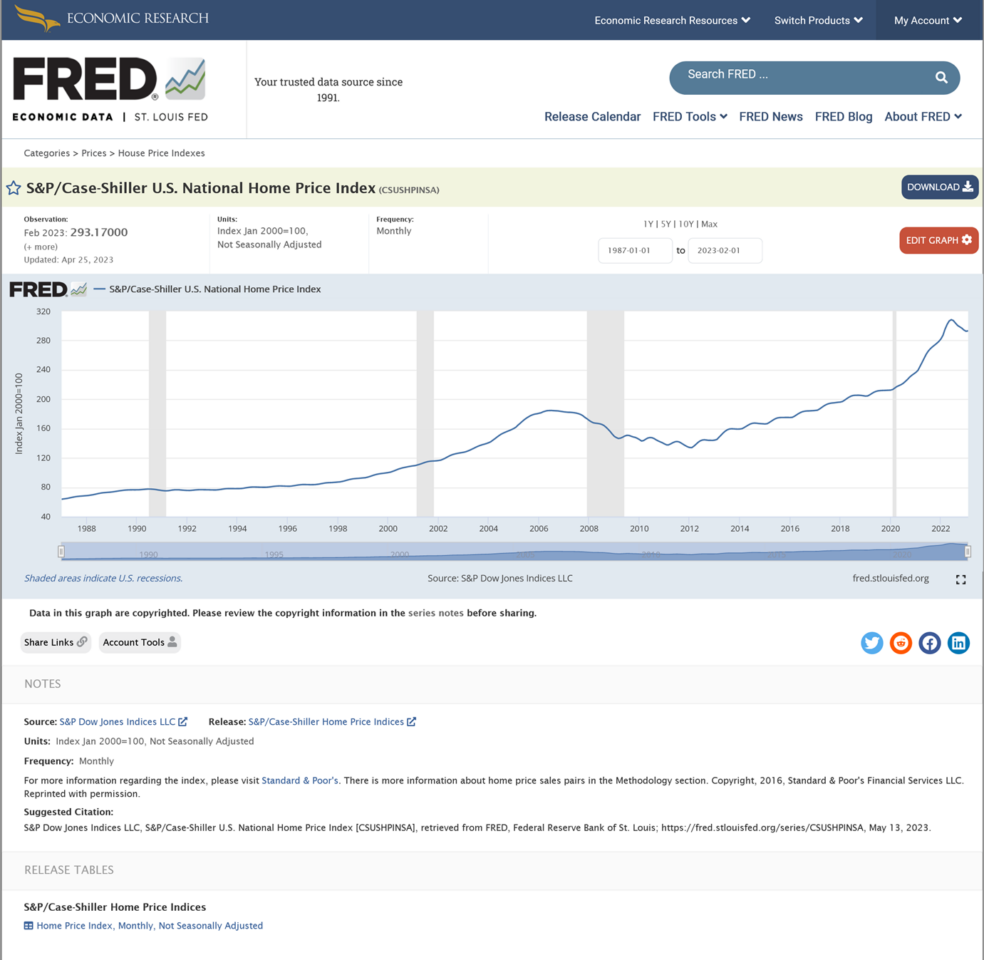

This explains why the St. Louis Federal Reserve shows the S&P 500 soaring more than four-fold faster than the Case-Shiller US National Home Price Index from 1987 to date (see figure).

However…

The Power of Leverage

Assuming you purchase a property using an 80% loan-to-value fixed-rate mortgage, any appreciation in the property’s value is all yours while the debt stays fixed in nominal dollars.

Here’s how things could play out if you buy a $500,000 home with a $400,000 mortgage.

After a year, the property could be worth $526,200 (5.24% appreciation). Ignoring the minor change in your mortgage balance, your equity will be $126,200 for an annual return of 26.2% (on your $100,000 investment)!

Adjusting for 4% annual inflation, your real return for the year is 21.3%!

But wait, there’s more…

If this is an investment property, you can depreciate your $500,000 cost over 39 years, reducing your taxable income by $12,821. With a 32% marginal tax rate (federal, state, and local), that’s an extra $4103 in your pocket, bumping your nominal return to 30.1%, and your real return to 25.1%!

“But what about the costs of ownership of that property?” you might wonder.

Even if you just break even on your cash flow (not a great investment situation), your renters cover all those costs for you.

Is it any wonder so many wealthy people invest in real estate?

How about my personal results?

What Worked Best for Me?

There’s no question that my best return was from starting my consulting business. It never required much financial investment, rewarding my time and effort very handsomely.

However, this article is about passive investments, so here we go…

Individual stocks: All these did (over the short time I owned them many years ago) was teach me the limits of my investing acumen. I’m a pretty good mutual fund picker, but a less-than-stellar stock picker… 😊

Mutual-fund portfolio: Recently, including the 2022 bear market, my annual return averaged 9%, close to the total return of the S&P 500 despite having 25-30% in cash and bonds since 2021.

Real estate: Comparing the profit we collect from rental properties plus our depreciation-based tax savings, we gain about 11% a year relative to the amount we’d clear by selling our properties (assuming 10% transaction costs and paying off the mortgages).

Why so little (that’s just a little higher than our mutual-fund portfolio’s return)?

It’s because I conservatively assume zero appreciation until we sell the properties.

If we’d assume a 5.24% annual appreciation, our total real estate return would jump by 12.5% to over 23% nominal or 18.5% inflation-adjusted return.

The reason we don’t match the general-case 25.1% real return mentioned above is that our leverage is far less than 5× by now. Had we borrowed more against our current properties to finance new ones, returning to a 5× leverage, our average overall return would be far higher (but so would our risk).

What Do the Pros Say?

I asked several financial professionals for their opinion on real estate vs. financial assets and here’s what they said.

Douglas Greenberg, President, Pacific Northwest Advisory agrees, “The important discussion here is one of liquidity needs, cash flow, and total return. Clients need to understand the illiquidity of real estate and the possibility they’ll need to inject additional cash. This raises a discussion of their time horizon. Most clients should own their homes to build equity since it’s usually less expensive than renting and you get to harness potential growth given inflation and demographics. As for buying a vacation home, the conversation is about the client’s investment goals, cash flow, lending rates, and opportunities for appreciation.”

Kevin Estes, Founder & Financial Planner, Scaled Finance elaborates, “One key consideration for investing in real estate is ‘Do you have time for a part-time job?’ If you don’t have time to find, update, rent, and manage the property, investing in real estate may not make sense. Even if you outsource property management, you’ll need to approve and fund big expenses. Those decisions take time and money.

“Another consideration is cash flow. Real estate entails ongoing expenses, some of which can be significant. For instance, a new appliance, roof, hot water heater, furnace, etc. Having multiple properties could result in many such expenses occurring at once. Someone without sufficient cash flow likely wouldn’t be a good candidate for real estate investing. A third consideration is optionality. Would the parcel qualify for a real estate capital gain exemption? Could the investment property become a personal residence one day?”

P. Timothy Uihlein, CFP®, MBA, Partner, Managing Director, and Senior Wealth Manager at Vincere Wealth Management says, “I’m a big proponent of investing in real estate, but you have to consider all relevant factors. Investing in real estate isn’t a quick way to get rich and reduce your tax burden. If you don’t do your due diligence, it can really hurt your finances. However, if it’s a good fit, we recommend most of our clients (especially high-net-worth and ultra-high-net-worth clients) consider real estate in their portfolios for diversification.“

Jorey Bernstein, Executive Director, Wealth Manager, and Founder, Bernstein Investment Consultants weighs the pros and cons of real estate investing, “Real estate offers potential appreciation, steady cash flow, tax benefits, leveraging equity to finance more properties, and diversification when added to a traditional stock/bond portfolio. However, it requires a significant initial investment, time-consuming and potentially expensive property management, possible loss of value, limited liquidity, and unpredictable and at times costly maintenance and repairs.

“If you go this route, avoid speculative investments and/or over-indebtedness, conduct thorough research of the local real estate market and potential tenants, and consider hiring a professional property manager to handle day-to-day operations. My investment philosophy emphasizes diversification and balancing risk vs. reward. While real estate investments can be a valuable addition to an investment portfolio, in most cases they shouldn’t replace it. Your ideal mix of investments will depend on your risk tolerance, investment goals, and financial situation.”

The Bottom Line

The stock market, on average, beats real estate by the proverbial mile. However, that ignores the leverage you get by using mortgages.

Accounting for a 5× leverage as well as the tax benefits of real estate depreciation, you can get an average inflation-adjusted annual return of >25% from real estate vs. (a still respectable) 12.2% from stocks.

Leveraged real estate thus has a much higher average return than non-leveraged investment in the stock market. However, as the expression goes, “TANSTAAFL,” or “There Ain’t No Such Thing As A Free Lunch!”

In the case of real estate, a high return isn’t a free lunch. You pay for it by taking on high risk and transaction costs:

- Investing directly in real estate requires a lot of capital (typically >20% of the property value), making a real estate portfolio far less diversified than a stock/bond/cash portfolio of the same size, increasing your risk

- The cost of investing in real estate (if you include the cost of selling) is over 10%, compared to the near-zero cost of investing in no-load mutual funds or ETFs

- The power of leverage cuts both ways — you magnify the returns on the upside, but also the losses on the downside — if your $500,000 property drops by 10% (assuming a 20% down payment) and you’re forced to sell, your loss is 50%!

Is real estate investing right for you? Perhaps, but only if you know what you’re doing and don’t take on more risk than you can afford.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals.

Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Find a Financial Advisor

Do you have questions about your financial future? Find a financial advisor who can help you enjoy life with less money stress by visiting Wealthtender’s free advisor directory.

Whether you’re looking for a specialist advisor who can meet with you online, or you prefer to find a nearby financial planner, you deserve to work with a professional who understands your unique circumstances.

Have a question to ask a financial advisor? Submit your question and it may be answered by a Wealthtender community financial advisor in an upcoming article.

–

Do you already work with a financial advisor? You could earn a $50 Amazon Gift Card in less than 5 minutes. Learn more and view terms.

This article originally appeared on Wealthtender. To make Wealthtender free for our readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a natural conflict of interest when we favor their promotion over others. Wealthtender is not a client of these financial services providers.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor