Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

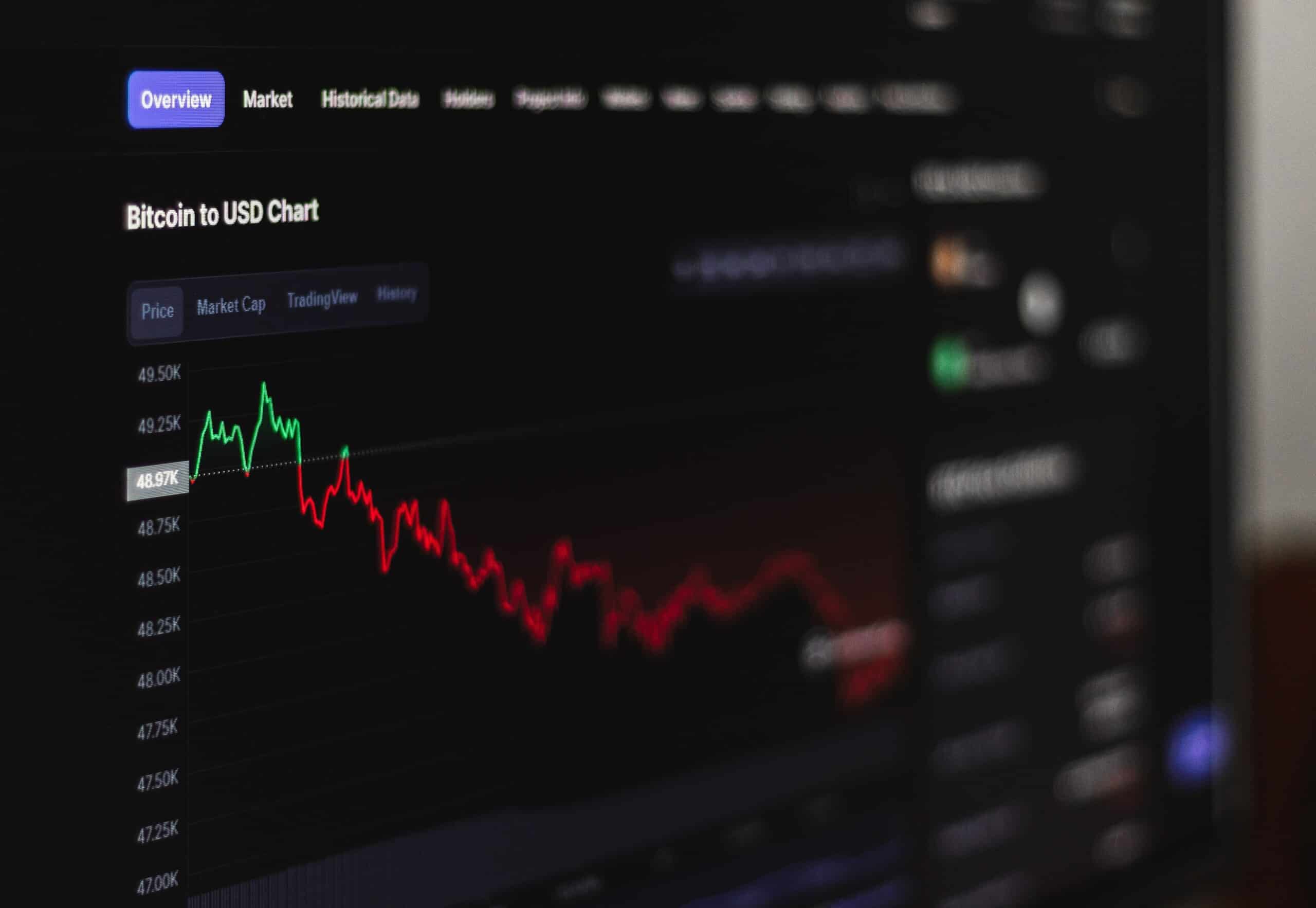

Cryptocurrencies retreated in price recently. Coins like Bitcoin and Ether are in sharp drawdowns after years of stellar returns. Individuals are left wondering what to do with their holdings—sell now or continue to ‘hold on for dear life. (HODL)’ There’s a tax-savvy way to go about managing a portfolio of digital assets.

Capital Loss Deduction

Tax-loss harvesting (TLH) is performed to take a current-year tax deduction. The tax benefit is not that large, though. The Internal Revenue Service (IRS) caps the amount an individual can claim as deductible losses to $3,000 per year. For a taxpayer in the 22% marginal bracket, that’s just a $660 annual savings. Still, performing a tax-loss harvest annually can make a difference over time.

What’s more, an investor can sell a particular coin at a loss, then simply buy the same coin immediately. Traders should be aware that repurchasing a security within 30 days of selling for a loss might trigger a wash sale with other assets, but that rule does not apply to crypto. Those rules could change in the future, so be sure to stay abreast of the latest tax laws.

IRS Cracking Down

Individuals need to be serious about getting their taxes right when it comes to digital assets. Case-in-point: The IRS asked taxpayers if they transacted cryptocurrency at the very top of Form 1040 for tax-year 2021. Crypto tax reporting is undoubtedly top of mind at the IRS. That makes it even more important that advisors know how to best help clients with crypto.

The upshot is investors can use tax rules to their advantage. TLH is an example. A taxpayer can either get money back or use the deduction to offset capital gains by claiming losses on their tax return. A capital gain happens when you sell a security for more than you paid for it—that goes for stocks, bonds, ETFs, and even crypto tokens.

Short-Term and Long-Term Capital Gains and Losses

It’s important to know that long-term capital losses (held more than one year) offset long-term capital gains. Short-term capital losses are only allowed to offset short-term capital gains. Losses can only offset gains of the same type.

It’s generally advisable to harvest short-term losses to offset short-term gains first since the tax rate on short-term capital gains is typically higher than the tax rate on long-term gains.

If an individual does not have capital gains, then all capital losses are simply a current-year tax deduction. The $3,000 deduction limit on capital losses, unchanged since 1978, applies to both single filers and those married-filing-jointly.

Taxpayers who have more than $3,000 in losses can carry forward the excess amount to future years to offset gains or take capital loss deductions.

Highest In, First Out (HIFO)

Many investors know about capital gains tax rules. They might even actively manage their positions annually to take advantage of the capital loss deduction. It’s often hard to know which assets to liquidate first to minimize long-term tax liability. The highest in, first-out accounting method is sometimes the best approach.

The “HIFO” strategy entails selling the asset with the highest cost basis first. “Cost basis” is simply what you paid for the asset. The investor can choose which lot to use as their cost basis after selling a cryptocurrency. You minimize capital gains tax by selecting the lot with the highest basis. The IRS requires that individuals keep detailed records of buying and selling activity. Seeking the help of an experienced tax advisor is recommended.

Interest on Crypto Holdings

It’s also important that investors pay tax on interest earned from staking coins as well as owning stablecoins. While typical money market funds and checking accounts offered scant interest in recent years, some investors earned strong yields in crypto—upwards of 10% on some assets. That interest income is taxable. Individuals should be sure to find 1099 forms for each crypto interest-bearing account they own. Like income from savings accounts and money market funds, missing a single 1099 form might result in receiving one of those unwelcomed IRS letters in the months after transmitting taxes to the IRS.

Don’t Forget About NFTs

The same tax rules apply to the growing non-fungible token (NFT) asset class. Tracking cost basis and sale amounts can be tricky with NFTs, so seeking the advice of a cryptocurrency financial advisor might be the prudent move. Consider hiring a financial advisor who has earned their Certified Digital Asset Advisor (CDAA) designation or their Certificate in Blockchain and Digital Assets.

ASK THE EXPERTS

We asked financial advisors in the Wealthtender community for their tips to make smarter money moves with cryptocurrencies.

Although there’s not yet a wash sale rule for digital assets, we expect one this year. If you want to harvest losses now and wish to maintain a somewhat consistent investment exposure, you might buy replacement tokens in the same digital genre such as Web3, Decentralized Finance, Interoperability, or Decentralized Exchanges.

Richard J. Archer, CDAA, CFA, CFP®, MBA | Archer Investment Management

If tax loss harvesting, transaction/gas fees will increase the cost basis and reduce the cryptoasset’s tax basis upon repurchase (losses are capped at $3,000 per year if you don’t have gains to offset them, but can be carried forward).

30-day wash sale rules currently do not apply to virtual currency. If you borrow against your crypto, the interest on the loan is tax deductible if the loan proceeds are used for investment purposes (e.g., to buy more crypto).

Being mindful of the holding period of crypto is important in order to take advantage of preferential long-term capital gains rates for investments held for over one year.

Roth conversions usually lead to a larger tax bill but are more palatable when asset prices are down and/or your taxable income is lower than last year (you can then use the converted money to invest in growth assets like crypto and never have to worry about income taxes again!)

Ryan Firth, CPA/PFS, CFP®, CCFC, GFP Fellow, RLP® | Mercer Street Financial

The Bottom Line

Figuring out taxes on crypto is the less fun task after engaging in thrilling token trading. While you owe capital gains from profitable investing, many individuals today are faced with losses on their crypto holdings. Three tools investors can use to soften the blow of losing money in digital assets are tax-loss harvesting, understanding how capital gains taxes work, and knowing which crypto lots to sell first to maximize the capital loss deduction.

Are you ready to enjoy life more with less money stress?

Sign up to receive weekly insights from Wealthtender with useful money tips and fresh ideas to help you achieve your financial goals.

About the Author

Mike Zaccardi, CFA®

Mike is a freelance writer for financial advisors and investment firms. He’s a CFA® charterholder and Chartered Market Technician®, and has passed the coursework for the Certified Financial Planner program.

Learn More About MikeWealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor