Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

The RMD rule changes included in the SECURE Act 2.0 are mostly welcome news to retirees, especially those who succeeded in building up large balances in their tax-deferred accounts.

Heading into 2023, President Biden signed into law a bi-partisan $1.7 trillion omnibus budget bill.

Tucked into that massive law is the so-called “Setting Every Community Up for Retirement Enhancement” (SECURE) Act 2.0, which makes some big changes to the American retirement-plan landscape.

One of the big areas of change is the dreaded “Required Minimum Distribution,” or RMD.

An RMD Primer

The RMD is what forces American retirees to draw certain minimum amounts from their tax-deferred retirement accounts (think traditional IRAs, 401k plans, SEP IRAs, etc.) once they’ve reached a certain age. That age, as of 2022, is 72.

The RMD is calculated based on your remaining life expectancy and your total balance in the affected accounts.

Say you’re a 72-year-old man who has $1 million in your affected accounts.

Your IRS life expectancy factor is 25.6, so you have to draw 1/25.6 of your $1 million, or $39,063. Of course, that means you have to pay income taxes on that amount.

But what if you only need $25,000 beyond your Social Security benefits?

Doesn’t matter. You still have to take out the full $39,063 RMD. That’s what the “M” stands for - ”Minimum!”

And if you don’t?

The penalty is a draconian 50% on every dollar you didn’t take. So, in the above example, if you only drew $25,000, you’d owe a $7032 penalty (50% of the remaining $14,063)!

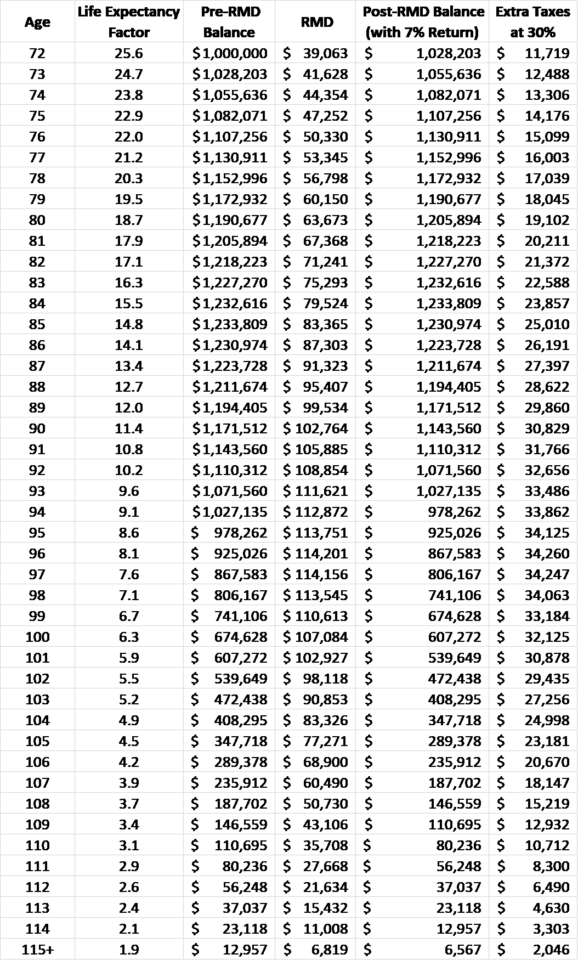

The following table shows how this plays out as you age, assuming an initial $1 million affected balance, a 7% annual return on your investments, and a marginal total (federal, state, and local) tax rate of 30%.

Every year, your RMD factor decreases, increasing the fraction of your account balances you’re forced to withdraw (and pay taxes on).

- At age 80, it’s 5.4%.

- At age 85, 6.8%

- At age 90, 8.8%

- At age 95, 11.6%

- If you’re lucky enough to reach age 100, 15.9%

- In the doubtful case that you live past 114, it’s 52.6%!

As you see, your hypothetical balance peaks at age 84, after which it starts dropping. If you reach age 94, it drops below your initial $1 million. If we’d consider inflation, your balance would drop below $1 million in real terms much earlier.

Meanwhile, your extra taxes keep increasing until age 96.

At that point, your balance drops so fast that your excess tax bill starts shrinking.

If you want to avoid RMDs altogether, you may be able to do so legally.

Significant RMD Changes as of 2023 Due to SECURE 2.0

The SECURE Act 2.0 makes several welcome changes to the RMD rules.

RMD – Start Age

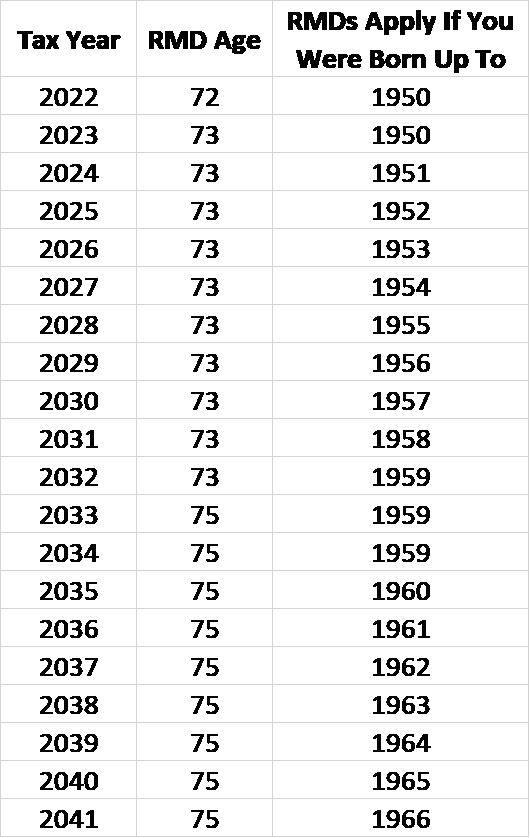

First, the age at which RMDs start increases to 73 in 2023 and increases again, to 75, in 2033. However, if you turned 72 in 2022, it’s too late for you.

Here’s how the new rules affect you depending on your birth year.

Given my birth year of 1962, for example, the new rules mean I won’t have to start with RMDs until age 75, in tax year 2037.

If you were born in 1959, you get “caught up” by RMDs at age 73, because that happens before the trigger age increases to 75.

RMD Penalties

Even more welcome is this second change…

The current (as of 2022) 50% penalty is among the most draconian ones in the entire US tax code (nearly 7000 pages of statutes and about 75,000 pages once you include federal tax regulations and official tax guidance).

SECURE Act 2.0 reduces the penalty to a far-more-plausible 25%.

Even better, say you forget to take your 2023 RMD; if you make up that shortfall by December 31, 2025, the penalty drops to 10%.

Sanity Breaks Out Regarding Roth 401(k) Plans

RMDs are intended to force retirees to pay taxes on money that was set aside in tax-deferred accounts. Though it made no sense, RMDs were required on after-tax Roth 401(k) balances.

The only way around that, until now, was to roll your Roth 401(k) balance into a Roth IRA (which isn’t affected by RMDs). The only problem with that was that if the Roth IRA was a new one, you might run afoul of the Roth IRA five-year rule and potentially have to pay taxes on growth in the account.

No more!

SECURE Act 2.0 finally fixes this travesty and excludes Roth 401(k) plans from the RMD rules altogether!

Annuities Treated Better

Before SECURE 2.0, if your account included both an annuity and a non-annuity part, you’d have to calculate the RMD separately for each, which in some cases increased your RMD amount.

SECURE 2.0 lets you combine the distributions, resolving this drawback of annuities.

Prior to the new Act, you could use a qualifying longevity annuity contract (QLAC) to shield from RMDs the lesser of $130,000 (as of 2022) or 25% of the retirement account balance. SECURE 2.0 removes the 25% part and increases the dollar limit to $200,000, which limit will be adjusted for inflation each year.

In addition, SECURE 2.0 now allows certain annuity payments that make annuities somewhat more attractive.

Widows/Widowers Treated Better

Up to 2022, if you left a tax-deferred retirement account to your spouse before you started taking RMDs (i.e., you died before you were forced to take RMDs), RMDs would take effect on that account once you would have reached the RMD trigger age had you lived.

The new law provides for a process wherein your widow/widower can request that their own age apply instead. So, if your spouse is say 10 years younger than you, s/he’d be able to avoid RMDs on the inherited account(s) for an extra decade.

Charity Becomes More Attractive

Until 2022, you could use a Qualified Charitable Distribution (QCD) to donate up to $100,000 a year and have that count toward your RMD. That $100,000 limit wasn’t adjusted for inflation, so it lost a fair bit of ground due to recent high inflation.

SECURE 2.0 allows the limit to be adjusted for inflation starting in 2024. Further, starting in 2023 you can make a one-time QCD of up to $50,000 through certain trusts and gift annuities.

Is Delaying RMDs Always a Good Idea?

In general, the above changes are good, if for no other reason than they open new possibilities, you didn’t have before. If delaying RMDs is a bad move in your personal situation, you can always draw more. After all, the “M” in RMD stands for “Minimum” not “Maximum.”

When Delaying RMDs May Be Bad for You

If it’s your first year to be caught up by RMDs, the rules let you put off taking your 2022 RMD until April 1, 2023.

However, you still have to take each subsequent year’s RMD by December 31 of that year, including 2023.

That means you’d have to take both your 2022 and 2023 RMDs in the same year, which may push your taxable income into a higher marginal bracket. That means you’d likely have to pay more excess tax on the total RMD amount than if you’d taken your 2022 RMD by December 31, 2022.

Beyond this, if you take advantage of the later onset of RMDs offered by SECURE 2.0, your affected balances will most likely be higher due to (up to) three extra years of investment returns. In addition, at age 75, your life expectancy factor will be smaller (22.9 rather than 25.6 at age 72).

For example, let’s assume a $1 million affected balance when you’re 72, with 7% annual growth and a 30% total marginal tax bracket. Delaying RMDs to age 75 under SECURE 2.0:

- Your affected balance at age 75 would be about $1.225 million.

- Your RMD would then be about $53,500.

- Your excess taxes would be about $16,050.

If your other taxable retirement income is high enough to push you into a higher bracket, your excess taxes could potentially be even higher.

In addition, the higher taxable income could increase taxes on your Social Security retirement benefits, your (income-based) Medicare Parts B and D premiums could go up, and your available tax deductions and/or exemptions could be smaller/fewer.

How Delaying RMDs Could Help You

However, delaying your RMD could offer some real advantages.

- You have up to three extra years for your affected accounts to grow while deferring taxes

- If the markets are down, you have up to three extra years to let your portfolio recover

- If the markets are up, you can convert to cash enough shares within your plan to cover 1–3 years’ worth of RMDs

- You have about one chance in nine of dying between ages 72 and 75, so you avoid RMDs, and if you have a younger spouse, s/he can delay RMDs even further

- You have up to three extra years to gradually convert money in affected accounts to Roth accounts that aren’t subject to RMDs, potentially at a lower marginal tax bracket

Who Benefits Most from These Changes, and Who Will Suffer?

I asked financial professionals in the Wealthtender community who will benefit most from SECURE 2.0’s changes to RMDs, and here’s what they said.

Michael Hunsberger, ChFC®, Owner, Next Mission Financial Planning, LLC says, “The new RMD rules will expand the time available to build and execute strategies to minimize taxes. It will benefit people who decide to work longer and wouldn’t otherwise have as much time to draw down their accounts or convert them to Roth accounts.

“People who don’t plan could end up paying more in taxes because they have to withdraw more over a shorter period from accounts that had several more years to compound. They could also end up leaving more to their heirs which is a positive, but with the 10-year distribution rule this could also drive taxes higher for the next generation.”

Allen Mueller, CFA, MBA, Founder and Financial Planner, 7 Saturdays Financial agrees, “The new RMD rules that extend the RMD age past 72 extend the ‘tax planning window’ for strategic Roth conversions and tax gain harvesting.

He adds, “This additional time may create opportunities for families to convert up to a lower bracket than they would have on a more compressed timeline, reducing their lifetime tax bill. For tax gain harvesting, they may be able to realize additional years of gains tax-free if they engineer their income to stay within the 12-15% federal tax bracket.

“The greatest benefits will be realized by those who don’t need their IRA distributions yet because they have low living expenses or other sources to fund their lifestyle — pensions, annuities, taxable accounts, etc.

“Delaying distributions can negatively impact heirs — if an IRA owner delays taking any distributions until age 75 and passes away soon after, the account beneficiaries would receive a large tax-deferred balance. Those who are ‘inheritance age’ are typically at their peak earning years. They would be forced to liquidate the entire balance within 10 years, adding to their tax burden. It would be preferable for them to receive a smaller IRA and a larger taxable account which receives a step-up in basis and no income tax impact.”

Zack Swad, CFP®, CWS®, BFA™, AWMA®, AAMS®, President & Wealth Manager, Swad Wealth Management, introduces a concept he calls ‘the Tax Valley.’ He says, “The ability to delay RMDs is a major boon for retirees who can afford to do so. Many retirees face a unique tax situation I call ‘the Tax Valley.’

“It’s the time between your retirement date and when you’re hit by RMDs that add taxable income to your other sources of retirement income such as pensions, annuities, and social security. In this Tax Valley, your tax bracket tends to be lower than either before or after. That’s why it’s a great time to consider a Roth conversion, moving money from a tax-deferred traditional IRA or 401(k) to a post-tax Roth IRA. The longer retirees delay RMDs, the longer their Tax Valley.

“Roth IRAs have three main benefits: 1) tax-free growth 2) no RMDs (3) tax-free withdrawals (if you’re 59.5 or older and meet the minimum account holding period — five years as of this writing). The downside is that you must pay ordinary income tax on the amount you convert.

“Pro-Tip: Be careful not to convert ‘too much’ or you’ll push yourself into a higher tax bracket for the year, which may negate the benefits of the conversion. Also, make sure you have money in a taxable brokerage or bank account to pay the taxes due on the conversion.”

Doug ‘Buddy’ Amis, CFP®, President and CEO, Cardinal Retirement Planning, Inc. rounds out the conversation, saying, “RMDs typically impact higher-income and higher-net-worth clients with lots of assets or enough passive income from other non-retirement sources far more than middle-class families. There won’t be a one-for-one connection, but a negative impact may be felt by the US taxpayer in general if there are lower tax receipts from the Act’s provisions as the federal budget continues to grow and interest rates are higher.”

The Bottom Line

When the government requires you to do something, you know it’s rarely to your benefit.

That’s why the RMD rule changes included in the SECURE Act 2.0 are mostly welcome news to retirees, especially ones who succeeded in building up large balances in their tax-deferred accounts.

Tax law is notoriously complicated, and various provisions interact with each other in ways that can send unexpected ripples through your finances.

That’s why, if you have significant resources and/or complicated taxes, you’d be well advised to hire a good tax advisor and ask him or her to project your taxes several years out (assuming no new provisions get enacted, simply because nobody knows what those might be) in order to advise you on how to best manage your RMDs, voluntary retirement-account draw-downs, and taxes.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor