To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

For many, retirement has been thought of as the end of work and a transition to a life focused on leisure. However, with increased life expectancy, this traditional definition of retirement is changing. Retirement is now viewed as another life chapter during which an individual retires from a current job or career but does not exit the workforce.

Nearly half of current retirees say have either worked or plan to do so in retirement, while close to 70% of pre-retirees plan to work during retirement. Increasingly, I have been having conversations with clients about working during retirement. Last week, I had several of these types of conversations – one with a 77-year-old taking on new work and another with a 64-year-old looking to switch careers.

Why Do Retirees Choose to Work?

There is a perception that people work in retirement because they need the money. While some retirees work primarily for the money, the great majority, over 80%, say that they are continuing to work in retirement because they want to rather than have to do so. Often retirees that do work feel that this work is a key to staying mentally active and feeling connected to others. A study published by Age Wave, an organization focused on trends for the aging population, highlights four distinct types of working retirees:

- Driven Achievers. Four out of five (79%) feel at the top of their game. 39% own a business or are self-employed. They are the most satisfied with work, and they tend to be workaholics, even in retirement.

- Caring Contributors. Seek to give back to their communities or worthwhile causes. Four out of ten (40%) work for a nonprofit, and more than a quarter are unpaid volunteers. Their impact is largely driven by their legacy goals.

- Life Balancers. Primarily want to keep working for the workplace friendships and social connections—and for the extra money. They seek work that is fun and not stressful and often work part-time.

- Earnest Earners. Need the income from working to reduce withdrawal stress on their portfolio for the lifestyle they want to continue to live. Sometimes it’s hard to adjust your lifestyle down to what is realistic for your savings. These individuals tend to continue to work as thought leaders i.e. consultants or on boards to continue their income to support their lifestyle.

The same study reveals that of those that do work in retirement, nearly half experienced a career intermission immediately after retirement for an average period of around two and a half years. Following this career intermission, retirees that do work, most often do so in part-time roles for which they find the work fun and fulfilling. There is also a growing wave of entrepreneurialism with retirees now starting businesses in retirement.

Different Approaches to Retirement

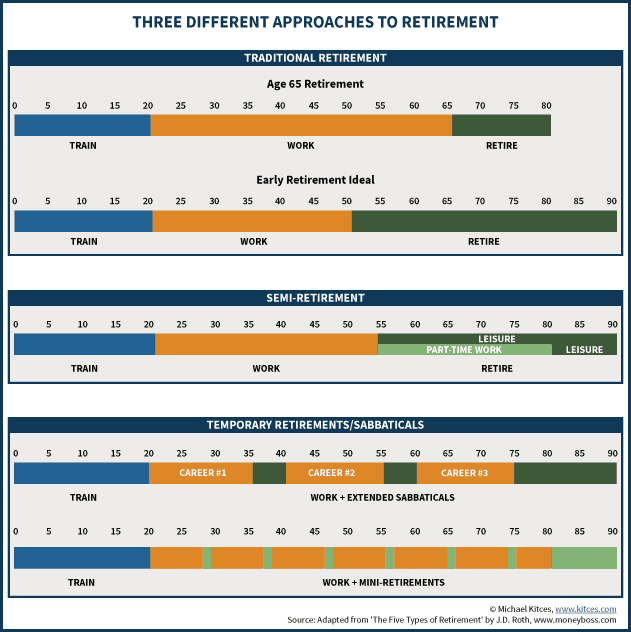

Retirement thinking is expanding to include other forms of retirement based on the level at which retirees choose to work. Below, we will highlight three different approaches to retirement and how each impact savings goals.

- Traditional Retirement – This type of retirement has historically been the prevalent approach to retirement planning. Work until a certain age and/or when financially feasible, exit the workforce, and then enjoy a retirement focused on active leisure. This type of retirement assumes retirement income comes from an individual’s assets and Social Security. For this type of retirement, the savings approach has been to start early, set annual savings goals, and create a portfolio focused on asset growth.

- Semi-Retirement – This is the fasting growing alternative approach to traditional retirement. In semi-retirement, the retiree does not exit the workforce but scales back working hours (i.e., part-time work). For this type of retirement, the retiree anticipates some level of ongoing and paid work to both provide personal fulfillment/well-being and financial assistance. Factoring in the financial contribution of semi-retirement can reduce the overall savings target needed for retirement enabling individuals to potentially semi-retire earlier and work longer overall.

- Temporary Retirements / Sabbaticals – In this model, breaks in work occur throughout an individual’s career. We most often see this type of retirement for serial entrepreneurs who have sold one business and take a break before jumping into the next venture. This impacts the amount of liquid cash needed and the amount of risk one can take since each venture could be considered high risk.

We are sharing these thoughts because we understand that retirement comes in many forms, and they can help you structure a wealth management strategy to meet your retirement needs. As some individuals are now looking past Covid and starting to plan for the future, it is more important now than ever to put pen to paper and work together to make this the next best decade.

This article was originally published here and is republished on Wealthtender with permission.

About the Author

Amar Shah

Amar Shah founded Client First Capital to create a platform that reflects his values and provides impartial, evidence-based advice to his clients around maximizing their financial well-being. Amar strongly believes that integrity, transparency, knowledge, and insight are core values for a successful, long-term client relationship.

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor