Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

You’d think getting a “raise” is good news. You’d be wrong!

Most years, the Social Security Administration (SSA) provides Cost-of-living Adjustments (COLAs) that increase benefits for retirees and others. When inflation runs high, those COLAs can be very high.

For example, CNBC reported in September 2022 that the 2023 COLA was expected to be up to 8.7 percent, the fourth-highest increase and the highest since 1981. “Hallelujah!” you may think when such large increases are announced. “That’s a huge raise for current retirees!”

How Social Security Benefit Increases Are Calculated and Why It’s a Problem

Prior to 1975, Congress had to legislate each Social Security benefits increase. Since then, benefits automatically increase based on the Bureau of Labor Statistics (BLS) Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). However, that index doesn’t reflect the rate of price increases for the elderly — which most beneficiaries of these benefits certainly are.

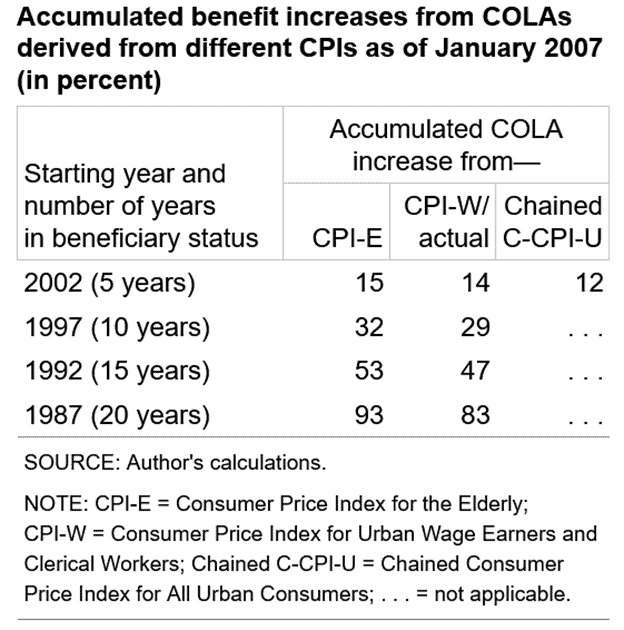

According to the National Committee to Preserve Social Security and Medicare (NCPSSM), the CPI-W underestimates the rate of price increases for the basket of goods and services of Americans 62 and older. This criticism isn’t new. In fact, the SSA was directed long ago to develop a special CPI measuring that rate, the Consumer Price Index for the Elderly (CPI-E). In 2007, the Social Security Bulletin reported that over the prior 20 years, the CPI-E increased 93 percent vs. 83 percent for the CPI-W (see table), which translates to 0.266 percent annually.

However, when measuring that 0.266 percent relative to the average annual COLA of 3.067 percent, it’s a relative 8.67 percent! That would make a 5.9-percent COLA 6.4 percent or 0.5 percent more and an 8.7-percent COLA 9.5 percent or nearly 0.8% more! In short, the larger the COLA, the greater the extent of the current short-changing of retirees.

The above-mentioned Social Security Bulletin article points out a variety of shortcomings of the CPI-E, including, e.g., that when prices increase, consumers often change their consumption by switching to less expensive alternatives and/or buying from cheaper sources.

They suggest using a so-called Chained Consumer Price Index for All Urban Consumers (C-CPI-U) instead, which would bias COLAs even lower than the CPI-W by another 0.35 percent annually.

Compared to the CPI-E, the C-CPI-U would thus shortchange retirees by 0.62 percent annually or a stunning 20.2 percent in relative terms! Thus, for a 5.9-percent increase based on the CPI-W, rather than increasing to 6.4 percent per the CPI-E, this would drop it to 5.1 percent. An 8.7 percent COLA, instead of increasing to 9.5 percent, would drop to 7.6 percent.

The More Accurate Way to Look at Large SSA COLAs

Reading mainstream financial media, you’d think large Social Security COLAs are a reason to rejoice. Barron’s, for example, reported in September 2022, “Retirees Could Soon Get Their Biggest Social Security Raise in More Than 40 Years.” Though the article pointed out that this COLA comes after a difficult year for retirees who had to deal with price increases while waiting a year for their “raise,” and mentions some tax drawbacks, it missed the most important point — the higher the COLA, the more retirees are short-changed by the SSA’s use of the CPI-W rather than the CPI-E.

If a retiree’s basket of goods increases in cost from $100.00 to $109.50, and the COLA increases $100.00 worth of benefits to $108.70, that retiree just lost $0.80 of purchasing power per $100. According to CNBC, “In April 2022, the average monthly benefit for retired workers was $1,666.49. The average monthly benefit spousal benefit was $837.34.”

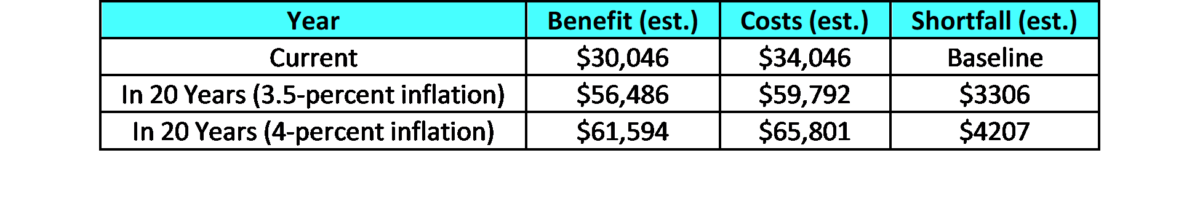

In 2022, the average retired couple thus received an annual benefit of $30,046. Without COLA, they would have lost $2607 worth of purchasing power. COLA helps a lot, even in its current form, making the decrease a far-smaller $240. Though a $240 loss is far smaller, it’s still significant for people living on a limited fixed income.

But Things Get Really Bad Over Time

Compounding this over a 20-year retirement makes things far worse. If the next 20 years see inflation averaging at its long-term historical 3.5 percent a year, prices 20 years from now would be about $199 per current $100. If the average increases slightly to just 4 percent, 20 years from now, prices would be $219 per current $100. Over that time, CPI-W-based COLAs would increase $100 of current benefits to $188 for 3.5-percent average inflation and $205 for the 4-percent case.

In those 20 years, the average retired couple’s benefit would thus increase in those two cases from $34,046 to $56,486 or $61,594, respectively, while $34,046 worth of expenses would have increased to $59,792 or $65,801, respectively. Thus, the retired couple would have a $3,306 benefit shortfall with 3.5-percent average inflation or a $4207 shortfall with 4-percent average inflation.

As you can see, the higher inflation goes, the worse the shortfall caused by using CPI-W instead of CPI-E. Changing over to the C-CPI-U would make things vastly worse for retirees.

The Bottom Line

While the SSA’s current CPI-W-based COLAs help retirees a great deal, they don’t fully correct for the price increases of the basket of goods and services purchased by retirees, as would a CPI-E-based COLA. If, as seems reasonable, the shortfall depends on how high inflation runs, a COLA of 8.7 percent implies a shortfall as high as $240 in a single year. Over a 20-year retirement, the average retired couple’s purchasing power could fall behind by as much as $4,207 (assuming inflation averages 4 percent a year), or 6.4 percent of their annual benefits. That’s a real problem.

What to Read Next:

- Should You Delay Taking Your Social Security Benefits?

- How to Maximize Your Spouse’s Social Security Benefits

- What Is a National Social Security Advisor (NSSA)?

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor