If you’re an individual or family with considerable wealth seeking a financial professional with the credentials to oversee a complex portfolio of investments, hiring a Chartered Financial Analyst (CFA) may be right for you.

Many CFAs also work with individuals and families who don’t yet have considerable wealth, while a majority hold positions at financial institutions in various roles, not working directly with individual investors.

Let’s take a closer look at what this designation is, what it takes to earn it, and if it makes sense for you to consider working with a CFA based on your individual requirements.

What is a Chartered Financial Analyst (CFA)?

A Chartered Financial Analyst (CFA) is a globally recognized and respected financial certification for financial professionals who would like to develop their expertise in investment management. It’s administered by the CFA Institute, which is an international organization that strives to promote knowledge and financial literacy in investments.

With a CFA designation, financial professionals gain the knowledge and skills needed to succeed in finance, banking, and securities. Its curriculum was specifically designed to reinforce a variety of important investment principles.

CFA graduates often evaluate the investment instruments and opportunities of their clients and use this information to make high-conviction recommendations. Therefore, this designation is often obtained by those who work for investment management firms, brokerage houses, or investment publications.

The CFA exam is so rigorous that it’s divided into three parts: Level I, Level II, and Level III. Financial professionals will begin with Level I and eventually work their way up to Level III. To be granted the CFA charter, they must earn a passing score on all three exams. Typically less than half of the candidates taking the CFA Level I exam each year achieve a passing score.

“What I loved about going through the CFA curriculum is that it not only covers the “basics” but also focuses on everything from concentrated financial positions, portfolio creation, impact and use of derivatives, quantitative analysis, and alternative investments, among many other advanced financial topics,” said Stephan Shipe, Founder of Scholar Financial Advising.

“Personally, having that depth of financial knowledge helps me to look at financial plans from a variety of viewpoints.”

Each level of the CFA exam covers a variety of subjects. Examples of these include financial statement analysis, equity valuation and analysis, quantitative methods, portfolio management, capital market theory, and venture capital.

Featured Chartered Financial Analysts on Wealthtender

📍 Click on a pin in the map view below for a preview of Chartered Financial Analysts who can help you reach your money goals with a personalized plan. Or choose the grid view to search our directory of CFAs with additional filtering options.

📍Double-click or pinch pins to view more.

Should You Hire a CFA?

A CFA has the advanced investment expertise and depth of financial knowledge that may help you if you:

- Are a High Net-Worth Investor: As a high-net worth investor, you want to make the most out of your money. Since your situation may be complex, you can count on a CFA charterholder to help you uncover investment opportunities that other financial professionals may not be able to find. They know what it takes to look beyond the surface and help you meet your short-term and long-term financial goals.

- Would Like Comprehensive Investing Help: If you have a large portfolio and would like a top-notch professional to manage your investments and securities, a CFA is a solid choice. They can provide you with the high-level management you need to maximize your investment income.

- Wish to Start a Business: A CFA can be very beneficial if you’re ready to take the plunge and start a business. You can trust them to help you evaluate and make smart investment decisions on a wide array of financial matters. They may also assist you in assessing potential risks that your organization is facing or may face in the future so you can avoid serious financial pitfalls.

- Are in Need of Extensive Financial Planning: If you’ve sold a business, gone through a divorce, lost a loved one, or unexpectedly accumulated a large sum of wealth, a CFA can help you navigate your new financial situation with comprehensive advice you may not be able to receive elsewhere.

“The only beneficial impact of having a CFA and having in-depth knowledge of the stock market on our jobs as advisors is more on our ability to explain what’s going on in a simple, easy-to-understand way,” said Blaine Thiederman, MBA, CFP.

“Why? Because in order to help our clients stay objective, disciplined, and grounded in their decision to stay invested and stay the course is vital to our ability to help them reach their goals. If you can’t stay disciplined in your investment strategy and get scared easily by the news, you’ll underperform those who are more than yourself.”

What Does it Take to Earn and Maintain the CFA?

Those who hope to earn a CFA designation must fulfill certain requirements set forth by the CFA Institute. Here’s a brief overview of the requirements:

CFA Education Requirements

Before a financial professional sits for Level I of the CFA exam, they need to complete or be in their last year of an undergraduate program in finance, economics, and business. If they’d like to continue to Level II of the exam, they must graduate with that degree.

CFA Experience Requirements

Financial professionals with at least four years of relevant work experience may be eligible to take the CFA. It’s important to note that while the experience must relate to business, it doesn’t have to do with the fields of finance or investments.

CFA Exam

The CFA exam is made up of three parts: Level I, Level II, and Level III. Level I consists of two sections and 240 total multiple-choice questions, which must be completed over three-hour sessions in the same sitting.

Upon passing Level 1, a CFA candidate can sit for the Level II exam a year later and the Level III exam a year after that. Level I includes 120 questions, which are divided into 20 “mini-cases” that are essentially real-life scenarios with questions. Level III also has case-based scenarios as well as several essay questions.

The CFA Board of Governors waits until the exams have been graded before determining the minimum passing score for each section. It’s important to note that the score varies on a yearly basis. Test takers won’t know exactly how many points they scored in each section, but they will find out if they scored below 50%, between 50-70%, or above 70%.

CFA Continuing Education Requirements

Once financial professionals pass the CFA charter, they are required to continue their education. The CFA Institute asks that all charterholders pay annual dues and participate in continued study to advance their careers.

How To Find The Best Chartered Financial Analyst For You

For most individuals and families, the financial advisor you hire may not hold their CFA designation, but you’ll often find your investments, like mutual funds and managed accounts, are overseen by investment professionals who are CFA charterholders.

If you prefer to work with a financial advisor who has earned their CFA designation, you can search the directory of CFAs on the CFA Institute website, and you’ll find a growing number of CFAs featured on Wealthtender this year.

What Do Chartered Financial Analysts Have To Say About Hiring A CFA?

We asked Chartered Financial Analysts in the Wealthtender community to answer questions we commonly hear from people thinking about hiring a financial advisor who has earned their CFA designation. Here’s what they said:

If you’re focused strictly on investing, you would want to find someone who has the Certified Investment Management Analyst® (CIMA) certificate or the Chartered Financial Analyst® (CFA) certificate,” says Jeremy Keil, CFA, CIMA®, founder of Keil Financial Partners. “Someone with the CIMA® designation is the highest level of investment education for constructing investment portfolios. The CFA® designation is the highest level of education for individual investment analysis.

Typically, you would ask a CIMA® professional to put together your investment mix of mutual funds and ETFs, which are collections of stocks and bonds. A CFA® charterholder would more often be focused on analyzing the merits of each individual stock and bond.

The CFA® curriculum is certainly more advanced than the CIMA® as it goes through the same topics as the CIMA® and then adds about 10x more! The CFA® curriculum involves passing 3 levels of examinations, each one tougher than the last. The average passing rate for each exam is 40%-50%, so you know that a CFA® charterholder has made it through a rigorous amount of investment knowledge!

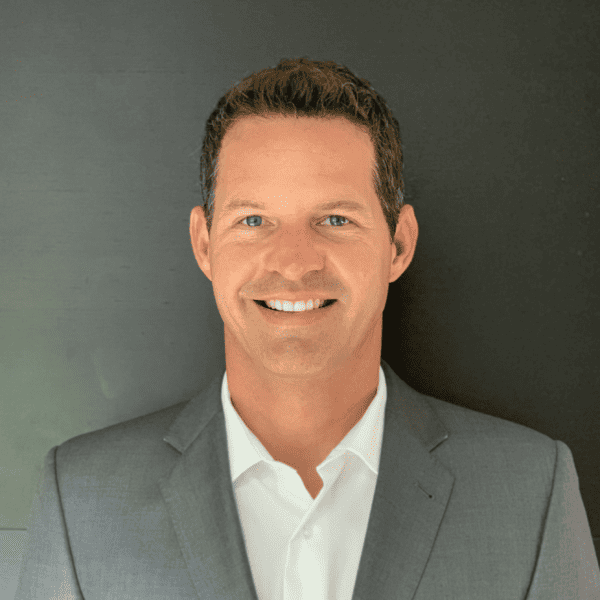

Jeremy Keil, CFP®, CFA, CIMA® | Keil Financial Partners

Consumers should not mistake the CFA designation for a guarantee of investment outperformance, but instead should view it as testimony to the advisor’s commitment to excellence through education. Obtaining the CFA designation is a grueling process with a high failure rate. It requires a high level of personal time commitment and academic rigor.

In addition to the CFA, look for the CFP designation for financial planning acumen, and/or the CPA or EA for tax acumen. Beyond that, you can look for credentials that relate to your specific needs. There are too many designations to count, and some are not worth the paper they’re written on.

However, a person with student loans might look for an advisor with the CSLP designation (Certified Student Loan Professional); CDFA for a person approaching divorce; CEPA for a person that may sell a business; etc.

Matt Smith, CFA®, CFP® | Concert Financial Planning

If part of your reason for hiring a financial advisor is to get help with managing your investments, you should consider working with a CFA charterholder. The CFA curriculum also includes sections on developing an investment policy statement – which is important in helping to set parameters around your portfolio in terms of goals and objectives, time horizon, liquidity constraints, specific investment approaches such as ESG, tax considerations, and risk tolerance.

The Chartered Financial Analyst (CFA®) designation has become the most respected and recognized investment credential in the world for measuring the competence and integrity of portfolio managers and investment analysts. All CFA charterholders are held to a stringent Code of Ethics and Standards of Professional Conduct.

Philip Weiss, CFA, CPA | Apprise Wealth Management

What other designations are important when seeking out a financial advisor?

Make sure any financial planner you are interviewing has the CERTIFIED FINANCIAL PLANNER™ designation.

Being a CFP® practitioner is table stakes in the financial services industry. Applicants must complete the rigorous Education, Examination, Experience and Ethics requirements to receive the CFP® marks, and then must obtain 30 hours of continuing education credit every two years to uphold the certification.

Many financial advisors place a heavy focus on numbers, projections, and the perfectly calculated financial plan that will get clients from point A to point B. The problem with this focus is that clients are rarely motivated solely by the data, so another credential I recommend looking for when hiring a financial planner is the Registered Life Planner® designation.

The RLP® marks are given to financial planners who have trained with the Kinder Institute of Life Planning and adopted a client-centric methodology that seamlessly combines the art and science of personal finance. These planners will first help clients discover the full life they long to live and then how to make it happen for themselves, removing mental roadblocks and using money as a tool to get there.

Kelly Klingaman, CFP®, RLP® | Kelly Klingaman Financial Planning

FAQs

How can I confirm the financial professional I’m working with holds the Chartered Financial Analyst designation?

Visit the directory of CFAs on the CFA Institute website.

What if I have a complaint about the Chartered Financial Analyst I’m working with?

Visit this page on the CFA Institute website to report misconduct by a member or candidate.

Where can I learn more about other professional designations held by financial advisors and coaches?

Refer to this list of popular financial certifications prepared by Wealthtender to help you learn more about each designation. You’ll find a brief description of each certification, plus links to in-depth articles if you want to learn more about a particular designation.

🙋♀️ Have Questions About Hiring a Chartered Financial Analyst?

Are you ready to enjoy life more with less money stress?

Sign up to receive weekly insights from Wealthtender with useful money tips and fresh ideas to help you achieve your financial goals.

About the Author

About the Author

Brian Thorp

Brian is CEO and founder of Wealthtender and Editor-in-Chief. He and his wife live in Austin, Texas. With over 25 years in the financial services industry, Brian is applying his experience and passion at Wealthtender to help more people enjoy life with less money stress. Learn More about Brian