To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Anyone who reads Mr. Money Mustache knows that the math behind early retirement is shockingly simple; The more of your take-home pay that you save, the earlier you will reach financial independence and be able to retire.

Let’s quickly define a few terms here so we are all on the same page.

Financial Independence/Early Retirement (FIRE): In the personal finance community these terms are often used interchangeably. Both Financial Independence (FI) and Retire Early (RE) amount to the same thing as it relates to your savings and investments. You have reached Financial Independence and have the ability, if you choose, to Retire Early once you have reached a point where your savings and investments can cover your living expenses for the rest of your life.

Put simply, reaching FI means you don’t need to rely on your job to cover your living expenses. For many, this is the point where they decide to retire (if they don’t have to work, they won’t) hence the term Financial Independence & Retire Early (FIRE).

Take home pay: How much of your income you keep after all taxes and deductions. Think of this as the actual money that gets deposited into your bank account on payday.

Savings rate: What percentage of your take-home pay are you saving/investing?

How much you can live on: How much money would you need (not want) to cover all your living expenses at your desired lifestyle.

So how do I Retire in 10 years?

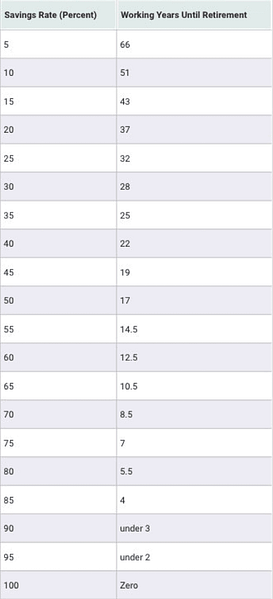

You simply need to save around 65% of your take-home pay over the next 10 years. I never promised an easy solution, but it is simple. Sometimes in life, the simplest things are incredibly difficult. Mr. Money Mustache has simplified things even more for all of us by doing the math to show us when we will reach FIRE given different savings rates. The following table reinforces the fact that our savings rate is the most critical factor in reaching financial independence.

Each of us will look at the above chart and find a different number that makes our jaw drop to the ground. As a personal finance nerd, the one that jumped out to me was the fact that at a savings rate of 10% (which is the recommended amount by many financial gurus) you would need to work for 51 years before reaching FI. Therefore, it should not be surprising to learn that more and more Americans are working into their 70’s.

The savings rate that many in the “FIRE community” strive for is 50%. If you can hit a 50% savings rate, Mr. Money Mustache’s math tells us we can retire in 17 years.

Let’s quickly review a few of the assumptions that Mr. Money Mustache makes in his math.

Assumption 1: Your investments earn 5% above inflation.

The key here is “above inflation”. To better understand how inflation impacts savers, read this post.

Assumption 2: You can live off the 4% safe withdrawal rate during retirement.

For more information on the “4% safe withdrawal rate”, read this post.

Assumption 3: Since you want this money to sustain yourself forever, you will only be withdrawing the “gains” not the “principle”. This ties in with the “4% rule”.

Why I love This Shockingly Easy Math

The thing I hear most from people when I talk about FI is “that’s nice for you, but I don’t make enough money to ever do that”. While it is true, the more money you make the easier you will be able to reach FI, but Mr. Money Mustache’s shockingly simple math focus completely on saving not income. We all can control how much of our money we spend. If you make $100,000 per year and you are spending $90,000 per year you are still on a 51-year track for retirement. If you make $50,000 per year and save $25,000 per year you are on a 17- year track for retirement.

So, what is the simplest way to increase your savings rate?

First, take a good hard look at your expenses and see what you can live without.

Have you ever stopped to consider what those pumpkin spice lattes are costing you?

Your Pumpkin Spice Lattes are costing you $250,000 and Pushing your Retirement Back Years

Let me get something out of the way, I love coffee, I would never advocate anyone kick coffee out of their life.

Once you have cut out all the frivolous spending, look at what is likely your biggest expense, your housing. If housing is your biggest expense, then it makes sense that the quickest way to increase your savings rate is to reduce this cost.

If you have never heard of the term “house-hacking, I strongly recommend you read this post.

Once you have addressed your spending issues, the next thing to focus on is increasing your income. Think of it this way, if you could double your income while maintaining the same lifestyle you do today, you will be well on your way to reaching Financial Independence in a reasonable amount of time.

Increasing your income is easier said than done and is where most people throw up their hands and say, “this isn’t for me”. Apart from the obvious measures you can take like seeking a promotion at work or finding a job that pays more money, there is a way you can increase your take-home pay starting today. That is to find a side hustle.

There are two classifications of side hustles, the “I just need straight cash” side hustles like becoming an Uber driver and the “Make money from my passion” side hustles like starting a personal financial blog.

I hope this post serves as a good motivation for many of you who may not feel like you could ever reach FI. I will continue to share stories, ideas and strategies on how we can all work to lower our spending, increase our income and make FIRE a reality for us all.

I am interested in knowing if you have ever heard of the term FI or FIRE before? After reading this what do you think is a reasonable savings rate you could reach in the next year and what are the major hurdles you think are standing in your way of that goal?

You Might Also Enjoy:

Are you ready to enjoy life more with less money stress?

Sign up to receive weekly insights from Wealthtender with useful money tips and fresh ideas to help you achieve your financial goals.

About the Author

Ben Le Fort

In the eight years following graduation, he paid off all of the debt and built a seven-figure net worth. Ben holds a Bachelor’s degree in economics from Acadia University and a Master’s degree in Economics & Finance from The University of Guelph.

Ben lives in Waterloo, Ontario, with his wife, son, and cat named Trixie.

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor