Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

You’ve thought about it and ruled out walking, public transportation, Uber, and even renting a car only when you must. None of that works for you.

You’re getting a car of your own, and that’s that.

Your options are to (a) buy new, (b) buy used, or (c) lease new. Which makes the most sense?

According to Ben Le Fort, buying a new car is a really bad idea. He calculates that if you make the median salary, financing, depreciation, gas, maintenance, and insurance cost 25% of your after-tax income.

However, that’s only true for the first year of ownership. Here are the true costs if you’re not silly enough (or make enough millions) to replace your car each year. (Editor’s Note: Also check out our new article reviewing the costs for new 2021 model year cars vs. used.)

Table of contents

Which Cars Should We Analyze?

To calculate the full cost of ownership, let’s first decide which cars we’ll look at. According to US News and World Report, the best non-luxury vehicles for the money in 2019 are:

- Best compact SUV: Honda CRV

- Best minivan: Honda Odyssey

- Best subcompact SUV: Hyundai Kona

- Best 2-row SUV: Nissan Murano

- Best 3-row SUV: Kia Sorento

- Best subcompact car: Honda Fit

- Best compact car: Kia Soul

- Best midsize car: Toyota Camry hybrid

- Best large car: Toyota Avalon hybrid

Calculating the costs for each of these is (quite a bit) beyond the scope of this story, so let’s analyze three examples. Specifically, buying a CRV, a Soul, or a Camry hybrid.

Should You Buy a New Car? 2021 Model Year Article Update:

Buying a New Car Is Really Expensive at First, but Over Time…

Buying new has several attractions.

- You get to choose the make, model, trim, options, colors, etc. exactly the way you want them.

- You get a brand-new vehicle and don’t inherit anyone else’s problems (e.g., no flood-rescue cars).

- Your repairs (and possibly maintenance) are covered by warranty for the first few years.

- You usually get a few years of repair-free driving.

On the other hand, depreciation is highest for a new car. You lose 5-10% as soon as you drive your new car off the dealer’s lot. By the end of year 1, you lose 8-25%! To reduce this hit, do what I do – keep your new cars for 10 years.

Full Cost of Ownership

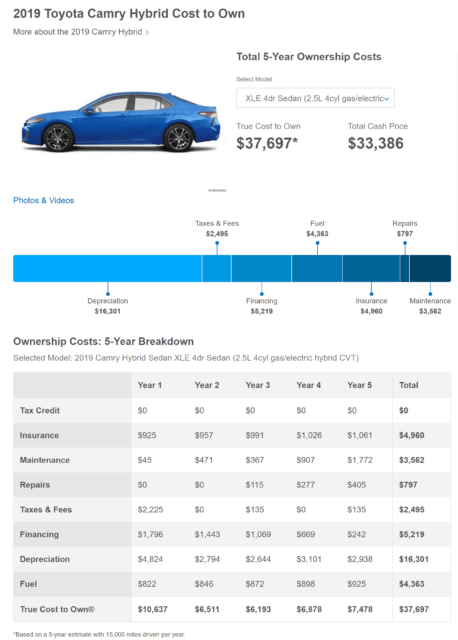

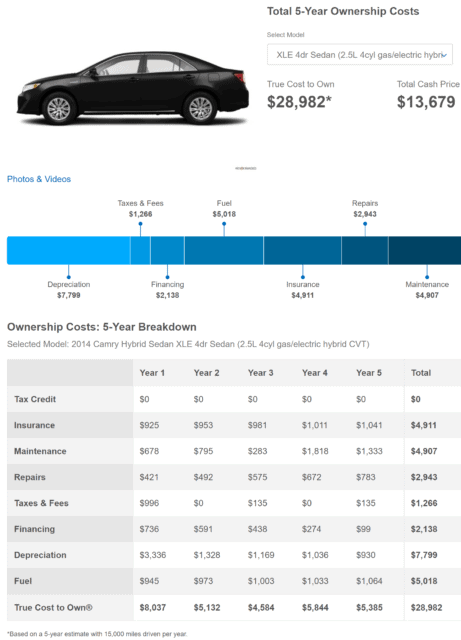

Edmunds.com has a nifty tool for estimating the full cost of owning vehicles for 5 years, accounting for region. The true cost to own includes maintenance, repairs, taxes & fees, financing, depreciation and fuel.

Edmunds only looks at the first 5 years of ownership, so we need a hack to calculate costs for 10 years. We estimate that by summing the 5-year cost of buying new to that of 5-year-old vehicles of the same model.

However, keeping the car you bought new for a second 5-year period doesn’t require buying it. Thus, we remove the financing cost and adjust the first year’s depreciation to be the average of year 5 of the new model with year 2 of the 5-year-old one.

Let’s see how this works out for the three vehicles we picked out.

Honda CRV

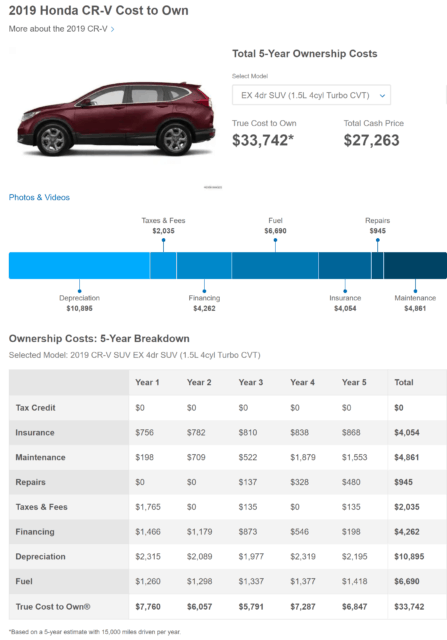

The cost to buy a new 2019 Honda CRV and keep it for 5 years is $33,742.

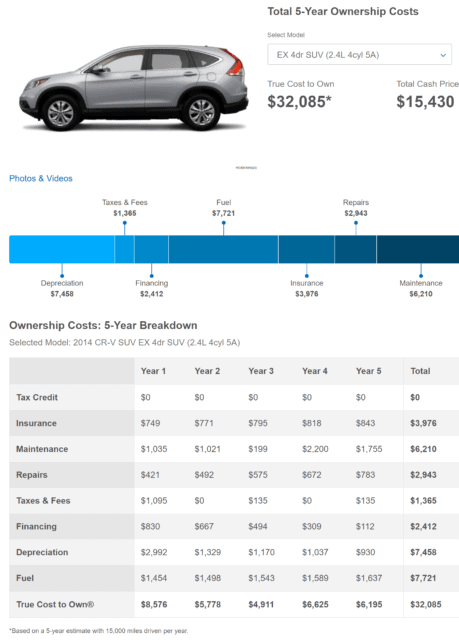

Buying a 5-year-old CRV and keeping it for 5 years would cost $32,085. However, if we remove the financing cost and adjust the year-1 depreciation as described above, we arrive at $28,443.

Adding this to the cost for the first 5 years, we get a total of $62,185, an average of $6219/year. Based on Le Fort’s $39,129 estimate of the median after-tax US income, this works out to ~16% of income.

Kia Soul

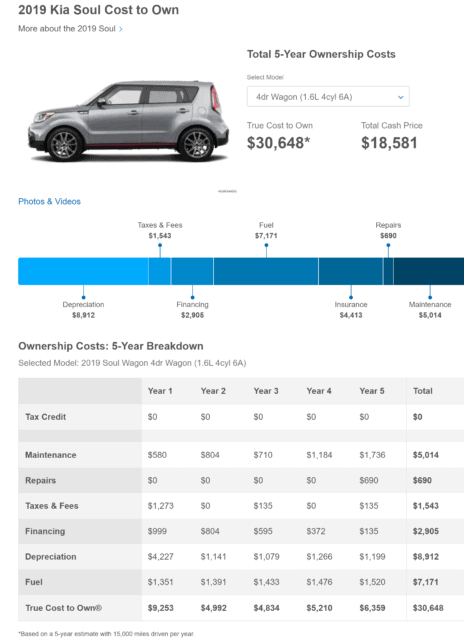

The cost to buy a new 2019 Kia Soul and keep it for 5 years is $30,648.

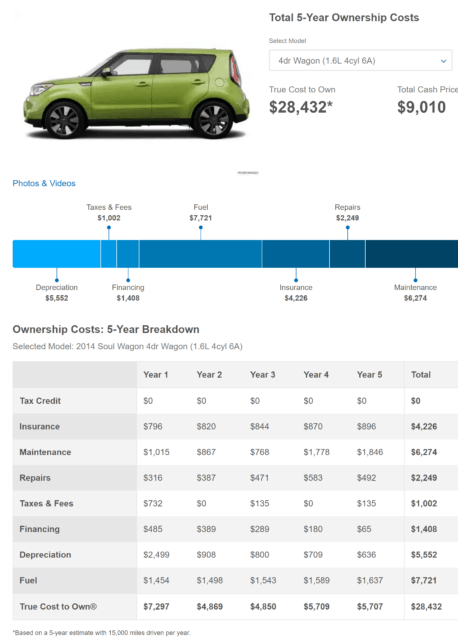

Buying a 5-year-old Soul and keeping it for 5 years would cost $28,432. Adjusting as above, we arrive at $25,578.

Adding this to the cost for the first 5 years, we get a total of $56,226, or $5623/year on average. This works out to about 14% of the median after-tax income.

Toyota Camry Hybrid

The cost to buy a new 2019 Toyota Camry hybrid and keep it for 5 years is $37,697.

Buying a 5-year-old Camry hybrid and keeping it for 5 years would cost $28,982. However, again adjusting as above, we arrive at $25,641.

Adding this to the cost for the first 5 years, we get a total of $63,338, or $6334/year. This works out again to ~16% of median after-tax income.

To summarize, depending on the car you choose, buying a non-luxury car new and keeping it for 10 years costs about $6000 a year on average. Of our examples, the least expensive was the Soul at $5623/year, and the most expensive was the Camry at $6334/year.

🆕 2021 Model Year Article Update:

Buying a Used Car Isn’t the Slam-Dunk Financial Case People Believe

Using the second 5-year period without adjusting the financing or depreciation costs, we get an average annual cost of $6417 for the CRV. Similarly, we get $5686 for the Soul and $5796 for the Camry.

Notice that this is more expensive than the average annual cost of buying new and keeping the car for 10 years for the CRV and Soul!

For the Camry hybrid, buying used saves about $45 a month. You may choose go for that savings; or you may prefer to drive a new car for the first 5 years of its life, especially if you make significantly more than the median salary.

Should You Arbitrage the Used Car Market Right now?

Leasing a New Car Makes Little Sense, Unless…

In almost all cases, leasing makes little financial sense, even if you drive relatively few miles (leases usually allow only 12,000 miles a year). You can count on the dealership to make sure they end up ahead financially (at your expense, obviously). However, there may be specific situations where this doesn’t hold true, or where you wouldn’t mind the financial loss.

- The dealership gets larger incentives from the manufacturer to lease cars rather than sell them (rare), so they offer an especially compelling lease deal.

- Your time is so valuable that it doesn’t make sense to waste it taking your car to the shop for repairs or finding a buyer or trade-in once you’re done with it (after 10 years, right?) – even in this situation, it might be more financially sensible to hire someone else to do it for you so you can avoid leasing.

- You make enough money to achieve all your personal finance goals while paying the usually higher cost of leasing, and you prioritize the comfort and luxury of driving a new or almost-new vehicle with the latest technology over the financial savings of buying new and driving the same vehicle for 10 years.

Caveats

The above methodology is indicative, but there are a few caveats.

- Car makers change their models from year to year, sometimes a lot. Thus, owning a 2014 model for 5 years starting now wouldn’t be exactly the same as owning the 2019 model from 2024 to 2029.

- We neglected the time-value of money, and costs are higher in the early years, so taking a straight average isn’t completely accurate.

- We neglected inflation, which will make the cost in later years higher in nominal dollars.

Having said all that, the above method gives you a reasonable handle on how to think about the cost of buying a new vehicle and driving it for 10 years vs. the cost of buying a 5-year-old model and keeping it for 5 years until it reaches the same 10-year age.

You could of course buy a 5-year-old car and drive it for 10 years, but then you start paying significantly higher repair costs (e.g., replacing an engine, a transmission, and/or for a hybrid, replacing the batteries). You’d also have to consider the value of your time spent waiting at repair shops, and the emotional toll of the aggravation involved.

The Bottom Line

Huge amounts of digital ink have been spilled about how terrible a financial mistake you’ll make if you buy new cars. In reality, buying new and driving your car for 10 years averages about the same cost (cheaper in some cases) than buying used, and is more fun. Leasing is rarely a good idea, but as mentioned above, in some cases you may find it to be the way to go.

Next: Trade in Your Old Financial Advisor for a Newer Model

Hopefully, your current financial advisor continues to serve you well. But if you’re unhappy with your current advisor, consider if now is the time to trade up to a newer model. You’ll find a diverse range of financial advisors featured on Wealthtender who live near you, or can work with you online.

📍 Click on a pin in the map view below for a preview of financial advisors who can help you reach your money goals with a personalized plan. Or choose the grid view to search our directory of financial advisors with additional filtering options.

📍Double-click or pinch pins to view more.

Are you ready to enjoy life more with less money stress?

Sign up to receive weekly insights from Wealthtender with useful money tips and fresh ideas to help you achieve your financial goals.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.

Learn More About Opher

Wealthtender is a trusted, independent financial directory and educational resource governed by our strict Editorial Policy, Integrity Standards, and Terms of Use. While we receive compensation from featured professionals (a natural conflict of interest), we always operate with integrity and transparency to earn your trust. Wealthtender is not a client of these providers. ➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor