How Does Indyfin by WiserAdvisor Compare to Wealthtender?

Key Takeaways:

✔️ Both Indyfin by WiserAdvisor and Wealthtender provide tools for advisory firms to collect and display SEC-compliant online reviews.

🏆 Wealthtender offers a more robust solution with additional digital marketing benefits available at a significantly lower price than Indyfin.

🏆 Wealthtender outranks Indyfin in industry recognition (‘extraordinary’ rating from advisors: 2024 & 2023 T3 Advisor Software Surveys).

How Wealthtender Compares to Indyfin by WiserAdvisor

Wealthtender is the first financial advisor review platform designed to be fully compliant with the SEC Marketing rule.

Learn how Wealthtender compares to Indyfin by WiserAdvisor and other review platforms in the comparison table below.

| Solution Provider |

|

|

|

|

| Company Website (Link) | Wealthtender | Indyfin by WiserAdvisor | Amplify Reviews | FMG Testimonials (Formerly Testimonial IQ) |

| T3/Advisor Software Survey User Rating (2024) | 8.03 (Extraordinary) | Not Rated | Not Rated | Not Rated |

| PRICING | ||||

| Lowest Monthly Cost (1 Advisor) | $49/mo. | $99/mo. | $99/mo. | $79/mo. |

| Multi-Advisor Discounts | Yes (5+ Advisors) | Unknown | Yes | Yes |

| INBOUND LEAD GEN BENEFITS | ||||

| Consumer Website | wealthtender.com | indyfin.com | ❌ | ❌ |

| Monthly Consumer Traffic ** | ↗️ 63,700 | ↘️ 967 | ❌ | ❌ |

| Domain Authority (SEO Strength) ** | ↗️ 42 | ↘️ 18 | ❌ | ❌ |

| Advisor Profile with Client Reviews (SEO/AEO Schema) | ✅ | ✅ | ❌ | ❌ |

| Advisory Firm Profile with Client Reviews (SEO/AEO Schema) | ✅ | ✅ | ❌ | ❌ |

| Gold Stars Appear in Google Search Results (SEO/AEO Schema) | ✅ | ✅ | ❌ | ❌ |

| Review Sync™ (Sync Firm Reviews to Advisor Profiles) | ✅ | ✅ | ❌ | ❌ |

| TESTIMONIAL MARKETING TOOLS | ||||

| Embed/Display SEC-Compliant Testimonials on Advisor Website | ✅ (↗️ Learn More) | ✅ | ✅ | ✅ |

| Easily Create Social Media Content from Client Testimonials | ✅ (↗️ Learn More) | ❌ | ❌ | ✅ |

| AWARD RECOGNITION | ||||

| Wealthtender Voice of the Client™ Awards | ✅ (SEO/AEO Schema) | ❌ | ❌ | ❌ |

| ADMINISTRATION FEATURES | ||||

| Dashboard to Manage Reviews | ✅ | ✅ | ✅ | ✅ |

| Convert Google Reviews to SEC-Compliant Testimonials | ✅ | ❌ | ❌ | ❌ |

| ADDITIONAL DIGITAL MARKETING BENEFITS | ||||

| Get Quoted in the Media | ✅ (↗️ Learn More) | ❌ | ❌ | ❌ |

| Get Featured in Local Guides | ✅ (↗️ View Guides) | ✅ | ❌ | ❌ |

| Gain Recognition for Areas of Specialization | ✅ (↗️ View Guides) | ❌ | ❌ | ❌ |

| Professional Advisor Community | ✅ (↗️ Learn More) | ❌ | ❌ | ❌ |

View Table Disclosures

** Domain Authority as of January 2025 (Source: Moz) & Estimated Monthly Consumer Traffic as of January 2025 (Source: Ahrefs)

*** Tools that enable consumers to submit Google Reviews introduce advisory firms to significant regulatory risk. In FINRA Regulatory Notice 17-18, FINRA offers guidance for Registered Representatives applicable to social networks (e.g., Facebook, LinkedIn, Google Reviews), stating: “FINRA does not regard unsolicited third-party opinions or comments posted on a social network to be communications of the broker-dealer or the representative for purposes of Rule 2210, including the requirements related to testimonials in paragraph (d)(6).”

Based on this language, FINRA makes it clear that the act of solicitation triggers disclosure requirements not supported by the Google Reviews platform.

Should SEC Registered Investment Advisors not subject to FINRA oversight expect the SEC to take a more lenient stance?

We don’t believe so and don’t think it’s worth the risk. Wealthtender believes it’s highly likely the SEC will take issue in upcoming exams and sweeps with advisors proactively soliciting reviews on platforms known to be incompatible with the Marketing Rule.

With its principles-based rule intended to ensure consumers gain important information to make more informed decisions, we don’t expect the SEC to look favorably upon a rampant proliferation of advisor reviews on platforms incapable of addressing the Marketing Rule’s prohibitions and disclosure expectations.

Further, we continue to hear from leaders of advisory firms who invited their clients to write reviews on Google, and some of their reviews discuss investment performance. This situation isn’t hypothetical. Advisory firms with the best of intentions realize their Google Business Profiles are now toxic, containing reviews with promissory language and content prohibited by the SEC Marketing Rule.

We could update our platform tomorrow to enable consumers to submit their reviews to Google. That’s not the issue. We’re simply not in the business of ‘doing it anyway’ and asking for forgiveness later.

We designed our platform for 100% compliance with the SEC Marketing Rule. We’re not here to get cute or help advisors bend the rules. We’re here to empower advisors to abide by them and succeed with compliant testimonial marketing. SEC enforcement actions are coming. Our goal is to help advisors and wealth management firms feel confident their approach to testimonial marketing and online reviews is fully compliant with the SEC Marketing Rule.

Indyfin FAQs

Can you help me transition to Wealthtender from Indyfin?

Yes, we have helped multiple financial advisors who were unhappy with their Indyfin experience transition to Wealthtender. Upon request, Indyfin will provide advisors with a spreadsheet that includes the details of their client testimonials. After advisors who leave Indyfin join Wealthtender, we work with them to import their client testimonials to be displayed on their Wealthtender profile.

Do you offer an Indyfin discount?

Yes. Financial advisors can join Wealthtender in less than 2 minutes by visiting this page, choosing a monthly subscription option, and entering coupon code INDYFIN to receive 50% off the first two months.

What does the WiserAdvisor acquisition mean for Indyfin’s future?

WiserAdvisor is a reputable lead gen platform and find-an-advisor service for consumers founded in 1998. Their leadership team has considerable industry experience and should be able to improve the Indyfin consumer and advisor experience in the years ahead. It will be interesting to see if they maintain the Indyfin brand and website or roll the platform under the WiserAdvisor brand.

In 2025, WiserAdvisor launched WiserAdvisor Growth, combining the lead gen benefits of WiserAdvisor and client reviews of Indyfin.

Join the Digital Marketing Platform Rated Extraordinary By Advisors

– T3 Advisor Software Survey, 2023 & 2024

“I reviewed Wealthtender and their client review process, and I am good with it, I actually, really like their process.”

Chief Compliance Officer, Barron’s Top 100 RIA Firm

Headquartered in VirginiaYour advisors’ reviews on Wealthtender send positive trust signals to Google.

Collect reviews compliantly on Wealthtender. Rank higher in search engines. Accelerate the trust-building process with prospects.

LEADING WEALTH MANAGEMENT FIRMS GROW WITH WEALTHTENDER:

Convert more prospects into clients with online reviews.

The SEC Marketing Rule is a game-changer for advisory firms. Wealthtender is the first financial advisor review platform designed for SEC compliance.

Certified Advisor Reviews™

Certified Advisor Reviews help consumers make smarter hiring decisions when choosing a financial advisor. Advisory firms can opt-in or turn off Certified Advisor Reviews at any time. Learn more.

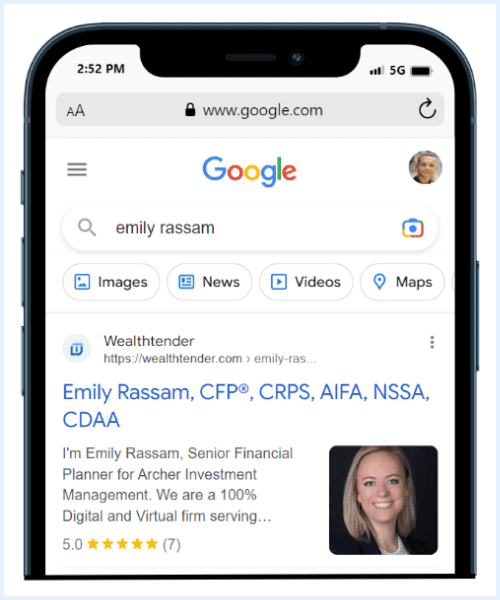

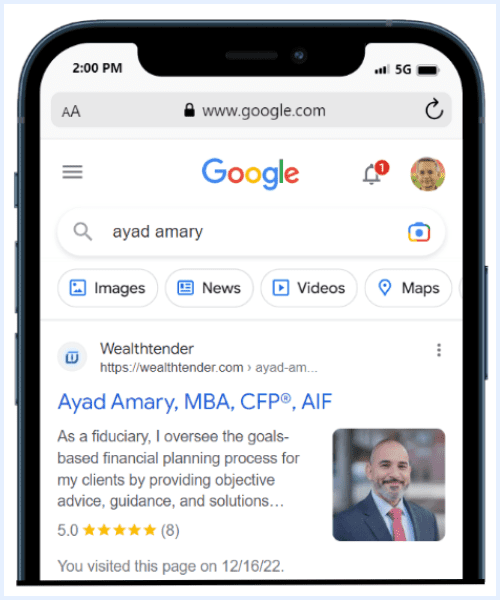

Your Stars Shine on Google

About one week after receiving their first reviews, advisors can expect to see their gold stars appear in Google search results with their Wealthtender profile page. These positive trust signals are powerful with prospects.

Reviews on Your Website

Wealthtender provides easy-to-use widgets to collect and/or display client reviews on your website, in addition to your Wealthtender profiles. Add a testimonials page to your website with just a few clicks. Learn more.

Compliance Friendly

Before a new review is published, a notification is sent to the financial advisor (or compliance designee) to add appropriate disclosures. Once added, the review is published. Watch the 7-minute demo video.

Take an Interactive Tour of Wealthtender

Get hands-on and discover why hundreds of wealth management firms and financial advisors

choose Wealthtender as their digital marketing partner.

Testimonial Marketing

Testimonial MarketingSuccess Story

Learn how United Financial Planning Group grows its business with a testimonial marketing strategy powered by Wealthtender.

Book a Demo

Select a day in the calendar below to schedule a meeting

with Brian Thorp, Wealthtender founder and CEO.

How Wealthtender Compares: Find-an-Advisor Directories

Wealthtender is the #1 find-an-advisor directory not sponsored by a wealth management firm, credentialing organization, or industry association.

Which Find-an-Advisor Sites are Right for You?

Beyond the industry affiliation and credentialing organization directories available to you, we’re happy to share a few thoughts below about find-an-advisor websites we’re asked about.

✅ Fee Only Network: If you meet its eligibility requirements, Fee Only Network is a reputable find-an-advisor site we recommend considering for the SEO benefits you gain at a very fair cost.

❌ FinancialAdvisors.com: While this site has a hard-to-beat domain name, FinancialAdvisors.com has a low DA rank and little consumer traffic, so this site doesn’t get our thumbs up.

❌ IndyFin: While most ‘matchmaker’ lead gen services don’t offer public advisor profile pages, IndyFin now offers profiles for $99/month as an alternative to taking a percentage of advisors’ revenue. While IndyFin’s DA rank has risen a bit recently, they generate relatively little organic traffic to their site, making the price appear steep.

✅ Wealthtender: Of course, we’re biased suggesting Wealthtender as one of the top find-an-advisor sites. But we’re also incredibly passionate about delivering unparalleled value to each advisor in our community for a small monthly cost.

Additional Directories: Your Credentials and Affiliations

Before you invest a single dollar in digital marketing, make sure you take full advantage of the benefits available to you through your industry affiliations and credentialing organizations.

Whether you’ve earned your CFP designation, you’re a member of a professional organization like the XY Planning Network or NAPFA, or you’re affiliated with another respected industry group, many of these organizations offer members a free directory listing in their find-an-advisor tool.

By ensuring your profiles in these industry directories are up to date, you’re putting your best foot forward with prospects and search engines like Google, Bing, and others.

Even if you don’t expect prospects to find you in these directories, most of these websites benefit from high Domain Authority (DA), providing you with valuable SEO benefits via the link from your directory listing to your website that can help you rank higher in Google search results.

💡 To acquire backlinks to your website of similar value through an SEO agency, you can expect to pay hundreds of dollars per link. Set a reminder to refresh these free profiles at least annually to maximize your membership ROI.

How Does Wealthtender Compare to Lead Gen Platforms Like Zoe Financial and Smart Asset?

Many financial advisor lead gen platforms take a percentage of your management fee when they match you with a prospect (e.g., Zoe Financial, Harness Wealth, IndyFin). Other platforms charge advisors hundreds of dollars and require you to compete with multiple advisors for leads they send to you (e.g., SmartAsset / SmartAdvisor).

While these services can be effective in adding new clients, the cost can be steep.

When you join Wealthtender, your flat fee digital marketing investment compounds over time, paying dividends when an increasing number of your future clients find you directly online. And when they do, your advisory fee is yours to keep.

To be fair, "costly" lead gen platforms like Zoe Financial and Smart Asset (among others) can often deliver a stream of prospects much more quickly than Wealthtender, but again, the cost can be steep. By comparison, the cost of one lead through Smart Asset (sent to 3 advisors to compete over) might cover the cost of a 1-year subscription to Wealthtender. And the cost of a new client acquired through Zoe Financial would easily exceed the cost of a 10-year subscription to Wealthtender.

This comparison is not to disparage these types of lead gen platforms, but to highlight the difference in economics across business models. This is one of the reasons why "paid web listings" on directory platforms like Wealthtender consistently rank as a Top 5 Marketing Strategy in the annual Kitces survey - The cost is a fraction of traditional lead gen platforms, offering the potential for outsized ROI.

Also, in many instances, a new prospect may first find an advisor through a site like Wealthtender, but not recall the site name once they click through to the advisor's website. Of course, we're happy with this outcome! But the downside is, we'll never be able to quantify the potential value of such introductions. Meanwhile, the upside for advisors when this occurs, there's zero incremental cost beyond the nominal monthly subscription cost paid to Wealthtender. Think of this as a marketing call option with very limited downside and the potential for considerable ROI.

With all of this said, we're not satisfied simply offering a basic "paid web listings" website. We continue to invest in our platform to ensure we're delivering an extraordinary value proposition to both increase the likelihood of consumers finding advisors through Wealthtender, while also offering digital marketing benefits at a fraction of the cost of marketing consultants, agencies, and public relations firms.

How Does Wealthtender Compare to Popular Online Personal Finance Publications Like NerdWallet and Investopedia?

Wealthtender, NerdWallet, and Investopedia are popular online finance publications that offer valuable education to consumers, primarily in the form of articles on a diverse range of topics.

NerdWallet is a publicly traded company that primarily generates its revenue from advertisers on its website comprised of credit card issuers, robo-advisors, mortgage lenders, and other companies offering financial products to consumers. While NerdWallet publishes many articles on its website about the potential benefits of hiring a financial advisor, their advertising primarily directs readers to robo-advisors and services not oriented to establishing a relationship with a traditional financial advisor.

Like NerdWallet, Investopedia primarily generates advertising from financial services companies that don't directly encourage establishing a relationship with a traditional financial advisor. Investopedia is owned by Dotdash Meredith, a media conglomerate that publishes print and online content, including brands like People Magazine, Better Homes & Garden, and Liquor.com.

Both Investopedia and NerdWallet experimented with resources to support traditional financial advisors in the past, and both companies shuttered these offerings, burning bridges along the way. The frustrations this created in the advisor community have been documented in articles written by Michael Kitces:

- Investopedia Advisor Insights: Why Most Financial Advisors Should Skip It

- Marketing Lessons Learned From NerdWallet Ask An Advisor Shutting Down

In retrospect, it is clear that both NerdWallet and Investopedia chose to prioritize what became a much more significant revenue stream for their businesses, revenue from credit card issuers and other companies that could offer economics not generated by their relationships with financial advisors.

Of course, there's nothing inherently wrong with the NerdWallet or Investopedia business models. Each company generates considerable profitability for its shareholders and investors.

Wealthtender is Designed with an Advisor-First Business Model

Unlike NerdWallet and Investopedia, the Wealthtender business model emphasizes the potential benefits for consumers to consider hiring traditional financial advisors. And the primary source of revenue for Wealthtender comes from the subscription payments from financial advisors, aligning economic interests with our financial advisor clients.

Wealthtender is an online publisher that offers education to help consumers make more informed and educated decisions to improve their financial health. Wealthtender does not provide matchmaking services to consumers, and instead, offers opportunities for financial advisors to gain visibility in various articles and directories, along with a platform to collect and display their reviews in a manner compliant with the SEC Marketing Rule.

Financial advisors interested in joining Wealthtender can learn more and sign up by visiting this page.