Introducing Certified Advisor Reviews™

Wealthtender offers the industry’s first financial advisor review platform designed for SEC Marketing Rule compliance.

Certified Advisor Reviews™ help consumers make smarter hiring decisions when choosing a financial advisor.

Collect and Display Reviews Compliantly

Unlike sites like Google and Yelp, your reviews on Wealthtender always include disclosures to satisfy regulatory and firm requirements. You can choose to only display client reviews and use admin tools to take actions to ensure regulatory compliance and protect the privacy of your clients. If your firm has received Google Reviews, Wealthtender’s import tool helps you unlock their potential to strengthen SEO (search engine optimization).

Build Trust with Prospects More Quickly

Online reviews accelerate the trust-building process with prospects. Beyond building credibility with your experience and credentials, online reviews written by your clients establish an emotional connection with prospects that helps them feel more confident about hiring you.

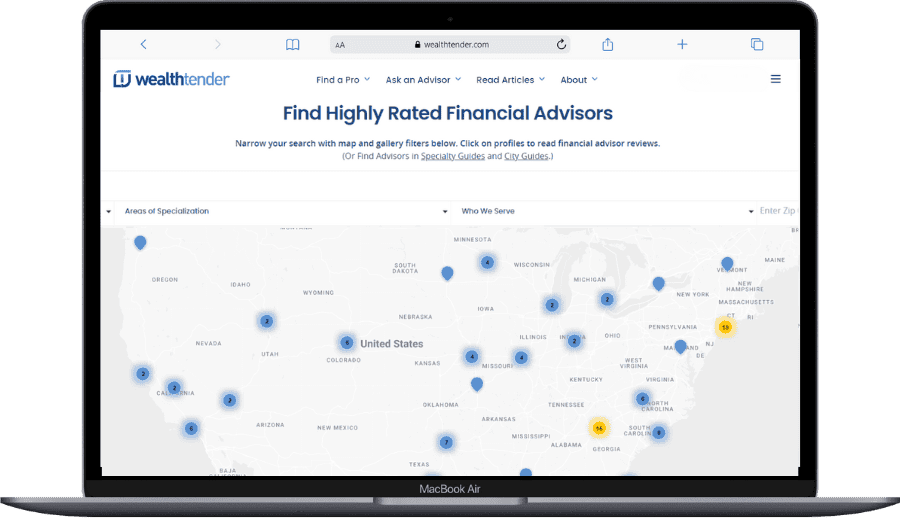

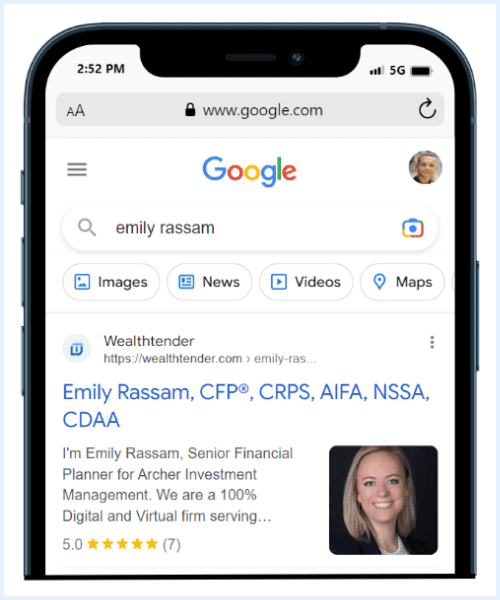

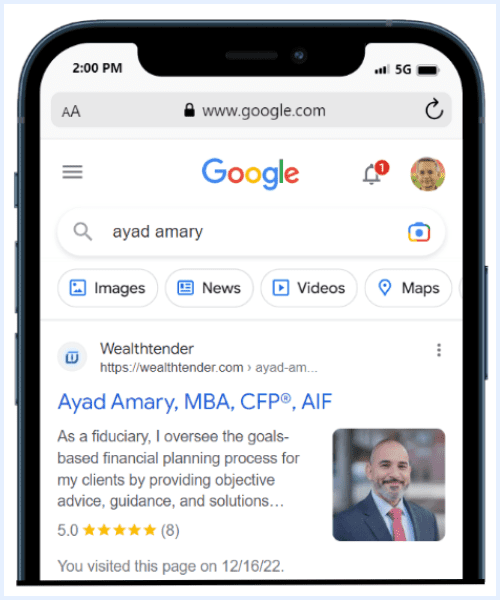

Rank Higher in Search Results and Win More Business

Your reviews appear on wealthtender.com, visited by nearly 500,000 consumers annually. Your reviews also send positive trust signals to Google’s algorithm, and your gold stars will shine bright in search results, helping you stand apart from advisors who lack reviews to win more business. It’s also easy to display reviews on your website, and Wealthtender offers tips and tools to help you promote your reviews compliantly in social media posts, too.

Join the digital marketing platform rated extraordinary by advisors.

– T3 Advisor Software Survey, 2023 & 2024

Take an Interactive Tour of Wealthtender

Get hands-on and discover why hundreds of advisors and wealth management firms

choose Wealthtender as their digital marketing partner and online reviews platform.

Your Reviews on Wealthtender Send Positive Trust Signals to Search Engines.

Collect reviews compliantly on Wealthtender. Rank higher in search results. Accelerate the trust-building process with prospects.

Testimonial Marketing

Testimonial MarketingSuccess Story

Learn how United Financial Planning Group grows its business with a testimonial marketing strategy powered by Wealthtender.

How Wealthtender Compares

Lower Cost. More Benefits. Wealthtender is the Leader in SEC-Compliant Testimonial Marketing.

| Solution Provider |

|

|

|

|

| Company Website (Link) | Wealthtender | Indyfin by WiserAdvisor | Amplify Reviews | FMG Testimonials (Formerly Testimonial IQ) |

| T3/Advisor Software Survey User Rating (2024) | 8.03 (Extraordinary) | Not Rated | Not Rated | Not Rated |

| PRICING | ||||

| Lowest Monthly Cost (1 Advisor) | $49/mo. | $99/mo. | $99/mo. | $79/mo. |

| Multi-Advisor Discounts | Yes (5+ Advisors) | Unknown | Yes | Yes |

| INBOUND LEAD GEN BENEFITS | ||||

| Consumer Website | wealthtender.com | indyfin.com | ❌ | ❌ |

| Monthly Consumer Traffic ** | ↗️ 63,700 | ↘️ 967 | ❌ | ❌ |

| Domain Authority (SEO Strength) ** | ↗️ 42 | ↘️ 18 | ❌ | ❌ |

| Advisor Profile with Client Reviews (SEO/AEO Schema) | ✅ | ✅ | ❌ | ❌ |

| Advisory Firm Profile with Client Reviews (SEO/AEO Schema) | ✅ | ✅ | ❌ | ❌ |

| Gold Stars Appear in Google Search Results (SEO/AEO Schema) | ✅ | ✅ | ❌ | ❌ |

| Review Sync™ (Sync Firm Reviews to Advisor Profiles) | ✅ | ✅ | ❌ | ❌ |

| TESTIMONIAL MARKETING TOOLS | ||||

| Embed/Display SEC-Compliant Testimonials on Advisor Website | ✅ (↗️ Learn More) | ✅ | ✅ | ✅ |

| Easily Create Social Media Content from Client Testimonials | ✅ (↗️ Learn More) | ❌ | ❌ | ✅ |

| AWARD RECOGNITION | ||||

| Wealthtender Voice of the Client™ Awards | ✅ (SEO/AEO Schema) | ❌ | ❌ | ❌ |

| ADMINISTRATION FEATURES | ||||

| Dashboard to Manage Reviews | ✅ | ✅ | ✅ | ✅ |

| Convert Google Reviews to SEC-Compliant Testimonials | ✅ | ❌ | ❌ | ❌ |

| ADDITIONAL DIGITAL MARKETING BENEFITS | ||||

| Get Quoted in the Media | ✅ (↗️ Learn More) | ❌ | ❌ | ❌ |

| Get Featured in Local Guides | ✅ (↗️ View Guides) | ✅ | ❌ | ❌ |

| Gain Recognition for Areas of Specialization | ✅ (↗️ View Guides) | ❌ | ❌ | ❌ |

| Professional Advisor Community | ✅ (↗️ Learn More) | ❌ | ❌ | ❌ |

View Table Disclosures

** Domain Authority as of February 2026 – Directional arrow reflects year over year trend based on the following DA scores for Wealthtender – ↗️ Feb 2026: 42, Jan 2025: 40 and Indyfin – ↘️ Feb 2026: 18, Jan 2025: 19 (Source: Moz) & Estimated Monthly Consumer Traffic as of February 2026 – Directional arrow reflects year over year trend based on the following consumer traffic figures for Wealthtender – ↗️ Feb 2026: 63,700, Jan 2025: 50,000 and Indyfin – ↘️ Feb 2026: 967, Jan 2025: 4000 (Source: Ahrefs)

*** Tools that enable consumers to submit Google Reviews introduce advisory firms to significant regulatory risk. In FINRA Regulatory Notice 17-18, FINRA offers guidance for Registered Representatives applicable to social networks (e.g., Facebook, LinkedIn, Google Reviews), stating: “FINRA does not regard unsolicited third-party opinions or comments posted on a social network to be communications of the broker-dealer or the representative for purposes of Rule 2210, including the requirements related to testimonials in paragraph (d)(6).”

Based on this language, FINRA makes it clear that the act of solicitation triggers disclosure requirements not supported by the Google Reviews platform.

Should SEC Registered Investment Advisors not subject to FINRA oversight expect the SEC to take a more lenient stance?

We don’t believe so and don’t think it’s worth the risk. Wealthtender believes it’s highly likely the SEC will take issue in upcoming exams and sweeps with advisors proactively soliciting reviews on platforms known to be incompatible with the Marketing Rule.

With its principles-based rule intended to ensure consumers gain important information to make more informed decisions, we don’t expect the SEC to look favorably upon a rampant proliferation of advisor reviews on platforms incapable of addressing the Marketing Rule’s prohibitions and disclosure expectations.

We could update our platform tomorrow to enable consumers to submit their reviews to Google. That’s not the issue. We’re simply not in the business of ‘doing it anyway’ and asking for forgiveness later.

We designed our platform for 100% compliance with the SEC Marketing Rule. We’re not here to get cute or help advisors bend the rules. We’re here to empower advisors to abide by them and succeed with compliant testimonial marketing.

Amplify the Reach of Your Firm’s Online Reviews.

Introducing Wealthtender Review Sync™ for Advisory Firms

Wealth management firms that join Wealthtender with 5+ advisors can activate the Wealthtender Review Sync feature.

Collect reviews on your advisory firm profile, and then once disclosures are added, your incoming reviews will display on each advisor’s profile on Wealthtender, in addition to your firm profile.

The benefits don’t stop there. When prospective clients search Google for your firm name or the name of any advisor, your gold stars appear in search results, strengthening your SEO and helping you stand out.

Prefer to let each advisor collect and display reviews individually on their profiles? That’s fine, too.

Michael Kitces Offers His Perspective on Certified Advisor Reviews™

“… Wealthtender is launching a more centralized “Advisor Reviews” platform, where advisors can sign up for a page on Wealthtender that centralizes all of their Google, Yelp, and other third-party website reviews, and repackages them as “Certified Advisor Reviews” (reviewed by Wealthtender) for which the advisor can add a Reviews badge to their website (linking to their Wealthtender profile).

…Nonetheless, the reality is that because testimonials have long been recognized as such a powerful marketing tool – including in financial services, where for decades they were only banned because they were deemed too influential and at risk for abuse! – it seems inevitable that client testimonials will soon become a core part of advisor marketing. The only question is how, exactly, advisory firms will find it best to collect and share them for the (right) prospects to see?”

– Michael Kitces at Nerd’s Eye View

The Latest in Financial #AdvisorTech (June 2021)

Get Started with Testimonials.

The new SEC Marketing Rule opens the door to new opportunities. And new risks.

We prepared this step-by-step playbook to help you compliantly turn your online reviews into an evergreen source of digital referrals. You might also enjoy our SEC Marketing Rule Education Series of articles, templates, and checklists designed to help you get started with testimonials and endorsements.

Wealthtender Founder and CEO Brian Thorp is a leading industry voice and subject matter expert on the SEC Marketing rule. Brian is a member of the National Society of Compliance Professionals (NSCP) and its SEC Marketing Rule Working Group. Schedule a 1:1 Zoom call.

Unable to Get Started with Testimonials?

It’s ok. You’re not alone. We know it could take some time before you’re able to move forward depending upon your registration status at federal and state levels (and when your compliance team is ready to give you the green light). When you’re ready, we’ll be here to help you get started.

Join Wealthtender today to strengthen your online reputation, build authority in your areas of specialization, and attract your ideal clients.

FAQs: Certified Advisor Reviews

We prepared these FAQs to help answer your questions about Certified Advisor Reviews from Wealthtender.

Have a question not addressed below? Please email yourfriends@wealthtender.com or schedule a 1:1 Zoom call with Wealthtender Founder and CEO Brian Thorp.

Looking for the One Page Quick Start Checklist? Instantly download it now (PDF).

What are Certified Advisor Reviews™?

Certified Advisor Reviews™ from Wealthtender help consumers make smarter hiring decisions when choosing a financial advisor.

Clients and other acquaintances of financial advisors can write a review on the Wealthtender profile page of advisors who have turned on the reviews feature.

Before each review is publicly displayed, financial advisors agree to provide Wealthtender with important information about their relationship with the reviewer to ensure consumers gain the transparency they deserve when their life savings could be at stake. These disclosures also help financial advisors satisfy compliance with industry regulations.

Upon receipt of the requested information from the financial advisor, Wealthtender completes the certification process and publishes the review with the Certified Advisor Review™ mark.

Financial advisors on Wealthtender who remain in good standing are authorized to display the Certified Advisor Reviews™ badge on their website, email signature and social media accounts.

What information is required for a review to become a Certified Advisor Review™?

To earn the Certified Advisor Review™ mark, a review must publicly display important information known to the financial advisor and usually not provided by a consumer writing a review. At a minimum, financial advisors must let Wealthtender know if:

- Compensation in any form was provided for the review

- Conflicts of interest may have influenced the review

- The review was written by a client or other acquaintance of the advisor

A Certified Advisor Review™ always displays this information clearly and prominently alongside the review to ensure consumers gain the transparency they deserve when their life savings could be at stake.

Certified Advisor Reviews™ also include supplemental disclosures provided by the financial advisor to meet federal and/or state regulatory requirements.

Can financial advisors edit a review?

In certain circumstances, the content of a review may contain language not permissible by the SEC or another regulatory agency. In such instances, Wealthtender will work with the financial advisor and/or their compliance officer to redact the disallowed language (or remove the disallowed language if it doesn’t affect the integrity of the review).

I see anonymous reviews on Wealthtender. How are those certified?

Wealthtender requires all reviewers to provide a valid email address. This information is shared only with the reviewed financial advisor to confirm their identity. Reviewers may request their review be publicly displayed with their full name, abbreviated name or anonymously.

Are financial advisors on Wealthtender required to collect and display reviews?

No. Wealthtender offers a wide range of benefits to financial advisors and our reviews feature is optional. Financial advisors may turn reviews on or off at any time.

Regulations at federal and/or state levels may also restrict or prevent financial advisors from collecting and displaying reviews. Wealthtender encourages all regulatory agencies to modernize their rules to allow online reviews so consumers can make more informed hiring decisions.

Can financial advisors republish Certified Advisor Reviews™ (and reviews published on other platforms) on their website?

Yes. In order to comply with the Federal Trade Commission (FTC) Consumer Review Fairness Act, online review sites like Yelp and Google (and Wealthtender) cannot claim copyright over consumer reviews. Accordingly, consumer reviews posted on any website may be republished elsewhere with permission from the review writer.

What methods can financial advisors use to display Certified Advisor Reviews™ on their website?

There are a couple of easy ways to compliantly display Certified Advisor Reviews™ on an advisor’s website. Both are pretty straightforward but require the explanation below as background for SEC compliance.

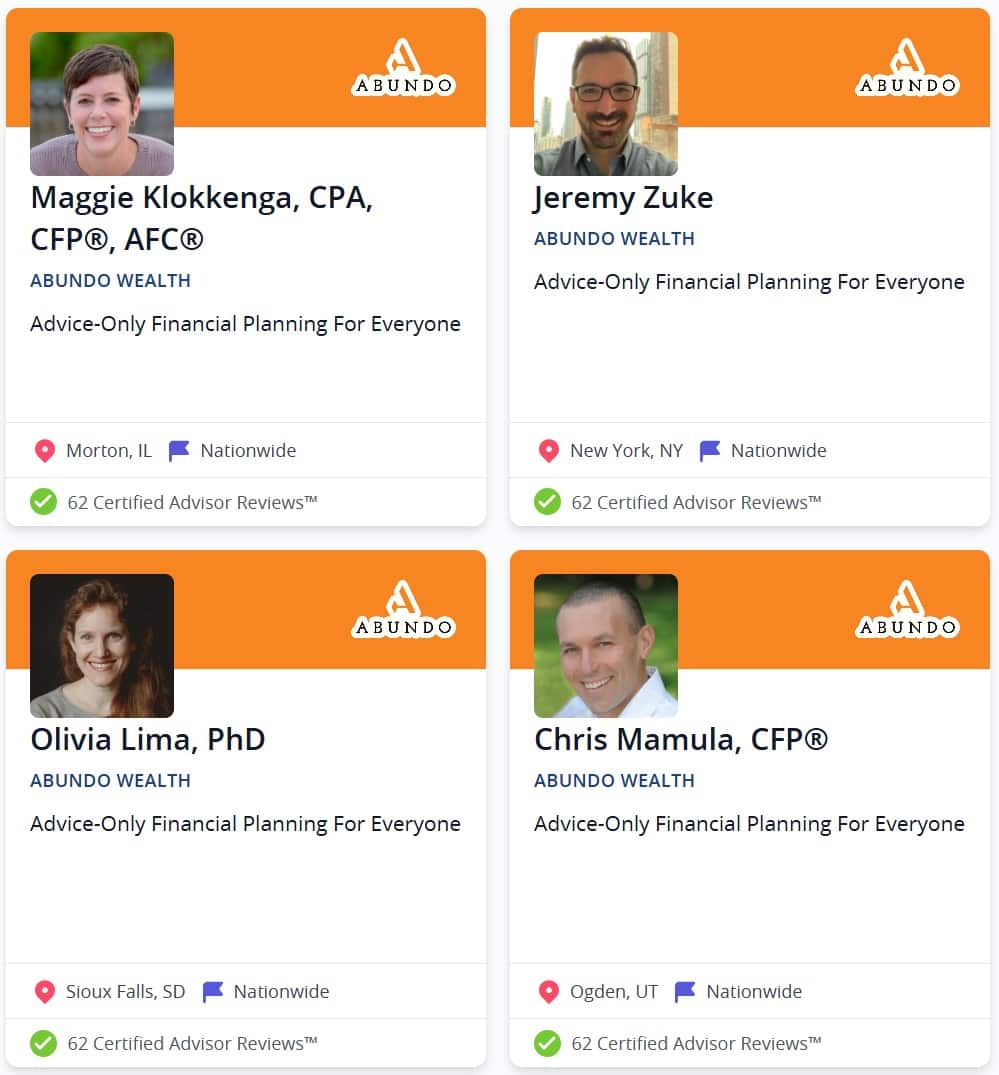

First, let’s see how Abundo Wealth, an SEC-registered investment advisor, chose to publish Certified Advisor Reviews on its homepage.

The team at Abundo Wealth asked their website developer to add a rotating carousel feature, which is a common website element available from most website providers.

In order to achieve compliance with the SEC Marketing Rule, they made sure to:

- Display the 3 required disclosures for each review “clearly and prominently” (e.g., client or non-client, compensated or not, any material conflicts).

- Since only a small sample of their reviews are showcased, they link to their Wealthtender profile page, where ALL of their reviews are available (so consumers can read every review if they so choose).

Officially, the SEC states each individual review needs to have its own “clear and prominent disclosures” with the 3 required disclosures, but in this case, since each review requires the same disclosures, the disclosure is written and presented once since the same disclosures are relevant and applicable to each of the rotating reviews (e.g., each reviewer is a current client, not compensated, no conflicts).

A second way to approach displaying Certified Advisor Reviews on an advisor’s website is to use a simple embeddable widget (HTML code that Wealthtender can provide upon request) that can be inserted on your site anywhere you like. Learn how to display testimonials on advisor websites.

Your developer can customize the dimensions to incorporate it seamlessly into your site on your home page, below your respective bios, within pages/articles, and/or anywhere else you like.

If you visit this article on Wealthtender about Abundo Wealth, you can scroll down to the text “✅ Read Certified Advisor Reviews™ for Abundo Wealth:” where just below this heading, you’ll see a widget in action where all of their reviews are accessible, including the required disclosures, compartmentalized to fit neatly into the flow of the article.

The benefit to approach 1) is that it affords you the ability to selectively showcase one, two, or multiple (but not all) reviews for a firm or individual advisor using a carousel, images of the reviews, or any other visual display of the reviews, without having to include every single review, and an ability to just spell out the disclosure once, assuming you choose reviews where the same disclosure can be applied to each.

The benefit to approach 2) is that you can place the widget anywhere on your site to showcase an individual advisor’s reviews without having to worry about any additional coding or addition of disclosures since everything required for SEC compliance is compartmentalized within the widget.

Are Certified Advisor Reviews™ compliant with the SEC Investment Adviser Marketing rule?

Certified Advisor Reviews™ from Wealthtender are designed to be fully compliant with the Securities and Exchange Commission (SEC) Investment Adviser Marketing rule.

Wealthtender developed Certified Advisor Reviews™ with the guidance of securities attorney Leila Shaver, founder of My RIA Lawyer and Shaver Law Group, LLC. With experience as General Counsel, Chief Compliance Officer and serving hundreds of financial advisors, Leila’s guidance and ongoing counsel ensures advisors can confidently and compliantly grow their business with Wealthtender’s modern marketing platform.

Wealthtender also monitors the SEC Marketing Compliance FAQ page daily for updates. Should additional guidance from the SEC warrant, Wealthtender will act promptly to conform with SEC requirements and expectations.

Are Certified Advisor Reviews™ compliant with FINRA Rule 2210 (Communications with the Public)?

In addition to being designed for compliance with the Securities and Exchange Commission (SEC) Investment Adviser Marketing rule, Certified Advisor Reviews™ from Wealthtender are also designed to be fully compliant with FINRA rule 2210 (Communications with the Public) and Regulatory Notice 17-18 (Social Media and Digital Communications).

Wealthtender believes the SEC Marketing rule generally sets a higher bar for disclosure requirements than current FINRA regulations for testimonials and endorsements of financial advisors. Accordingly, Certified Advisor Reviews™ align to the SEC Marketing rule requirements to ensure a fair and balanced approach across all advisors with reviews on the Wealthtender platform, regardless if they are an Investment Adviser Representative, Registered Representative or Dually Registered Financial Professional (or State-registered Investment Adviser in a state which has conformed to the SEC Marketing rule). This approach offers consumers a consistent experience and improved ability to weigh the merits of advisor reviews and make more informed hiring decisions.

Wealthtender developed Certified Advisor Reviews™ with the guidance of securities attorney Leila Shaver, founder of My RIA Lawyer and Shaver Law Group, LLC. With experience as General Counsel, Chief Compliance Officer and serving hundreds of financial advisors, Leila’s guidance and ongoing counsel ensures advisors can confidently and compliantly grow their business with Wealthtender’s modern marketing platform. Wealthtender also monitors the SEC Marketing Compliance FAQ page daily for updates. Should additional guidance from the SEC (and/or FINRA) warrant, Wealthtender will act promptly to conform with updated regulatory requirements and expectations.

Under what circumstances may a review submitted on Wealthtender be removed or not published?

Financial advisors may request a review be removed or not published if it is disallowed by the SEC or another regulatory agency. For example, if the reviewer meets the SEC definition of a “bad actor”, financial advisors can submit a form attesting to this disqualification provision and Wealthtender will promptly remove the review.

Wealthtender also abides by the Federal Trade Commission (FTC) Consumer Review Fairness Act and may unilaterally (or in coordination with financial advisors and their compliance officers) prohibit or remove reviews deemed inappropriate or irrelevant.

Also, Wealthtender automatically deletes spam and reserves the right to remove profane and indiscernible reviews lacking substance.

Why should financial advisors consider converting Google Reviews into Certified Advisor Reviews™ on Wealthtender?

By converting reviews from sites like Google into Certified Advisor Reviews™, financial advisors provide consumers the transparency and additional information they deserve to judge the accuracy and merits of reviews.

And because Certified Advisor Reviews™ are designed to be fully compliant with the SEC Marketing rule, financial advisors can turn reviews otherwise off-limits into powerful testimonials to proactively attract new clients.

Learn more about Google Business Profiles and Google Reviews for Advisors.

How do financial advisors convert Google Reviews into Certified Advisor Reviews™ on Wealthtender?

Wealthtender makes it easy for financial advisors to convert Google Reviews into Certified Advisor Reviews™ on Wealthtender.

Upon joining Wealthtender, advisors can use the Google Reviews import tool to easily add disclosures and through Wealthtender’s certification process.

Learn more about importing Google Reviews to Wealthtender.

Why does Wealthtender reference online review platforms Yelp and Google among its FAQs?

Wealthtender holds Yelp and Google in very high regard and recognizes their leadership position among online review platforms and popularity with consumers. However, without structural changes to their platforms, these sites and other online review platforms are not designed to provide consumers the transparency they deserve when their life savings could be at stake, nor do they offer the required disclosures for financial advisors to refer prospects to these sites.

Further, we continue to hear from leaders of advisory firms who invited their clients to write reviews on Google, and some of their reviews discuss investment performance. This situation isn’t hypothetical. Advisory firms with the best of intentions realize their Google Business Profiles are now toxic, containing reviews with promissory language and content prohibited by the SEC Marketing Rule.

Wealthtender also believes financial advisors who choose to collect online reviews on sites like Yelp and Google risk unintended consequences not commonly known. For example, Yelp penalizes businesses that proactively ask for reviews and Google’s algorithms sometimes remove legitimate reviews which can’t be reinstated.

Templates & Checklists

Why Financial Advisor Reviews Matter

The SEC Marketing rule offers opportunities for advisors to succeed

as the next generation of investors becomes the now opportunity for growth.

Learn how you can make the most of online reviews to grow your practice:

The Problem(s) with Google Reviews

Google and Yelp are well-known review platforms popular with consumers. And many advisors already have unsolicited reviews written about them visible on these sites. If these are favorable reviews and are truly unsolicited, that’s terrific as advisors gain SEO benefits and visibility among consumers visiting these sites.

However, because reviews on Google and Yelp lack the required SEC disclosures to be considered advertisements (e.g., testimonials and endorsements you can promote to grow your business), advisors can’t direct prospects to check out their reviews on these platforms.

Advisors should think twice before using Google to collect reviews. Here are a few reasons why:

- It is unlikely Google will modify its platform to make Google Reviews compliant if the SEC deems a review to be an advertisement.

- When advisors ask clients to leave a review on Google, it may be deemed an advertisement by the SEC, according to securities industry attorney Max Schatzow. If this occurs, advisors will be in violation of the SEC rule as Google is not designed to comply with SEC disclosure requirements.

- We continue to hear from leaders of advisory firms who invited their clients to write reviews on Google, and some of their reviews discuss investment performance. This situation isn’t hypothetical. Advisory firms with the best of intentions realize their Google Business Profiles are now toxic, containing reviews with promissory language and content prohibited by the SEC Marketing Rule.

- While the SEC will let advisors compensate clients for a review, Google prohibits the practice.

- Requesting the removal of Bad Actors as defined by the SEC will require filing a legal violation, which can take time and effort.

Here’s What We Don’t (Yet) Know:

Unlike unsolicited reviews published on Google or Yelp, the SEC has not formally offered guidance to clarify if solicited reviews on Google and Yelp are deemed an advertisement and, therefore, subject to the prohibitions and disclosure requirements described in the SEC Marketing rule. So the question we need the SEC to answer is: Does the act of a financial advisor simply asking for a review to be written on specific platforms like Google or Yelp entangle an advisor in its creation and trigger the prohibitions and disclosure requirements?

While industry opinions are mixed on the guidance the SEC will ultimately provide, we believe it’s highly likely the SEC will take issue with advisors proactively soliciting reviews on platforms known to be incompatible with the Marketing rule. With its principles-based rule intended to ensure consumers gain important information to make more informed decisions, we don’t expect the SEC to look favorably upon a rampant proliferation of advisor reviews on platforms incapable of addressing the Marketing rule’s prohibitions and disclosure expectations.

We continue to hear from leaders of advisory firms who invited their clients to write reviews on Google, and some of their reviews discuss investment performance. This situation isn’t hypothetical. Advisory firms with the best of intentions realize their Google Business Profiles are now toxic, containing reviews with promissory language and content prohibited by the SEC Marketing Rule.

Further, we believe the SEC could point to FINRA Regulatory Notice 17-18, which addresses this topic covering testimonials of registered representatives. In the notice, FINRA states: “FINRA does not regard unsolicited third-party opinions or comments posted on a social network to be communications of the broker-dealer or the representative for purposes of Rule 2210, including the requirements related to testimonials in paragraph (d)(6).”

Wealthtender has submitted written requests for clarification on this matter to the SEC (likely along with many other industry participants) and we monitor the SEC’s Marketing rule FAQ page daily. We’ll share updates as additional SEC guidance becomes known.

October 12, 2021 Update: The SEC Investment Adviser Regulation Office (within the Division of Investment Management) responded by email to Wealthtender confirming their team will consider updating the SEC Marketing rule FAQ page to address the analogous question answered by FINRA in Regulatory Notice 17-18 that could put this matter to rest.

September 3, 2023 Update: Unfortunately, nearly two years later, the SEC still hasn’t chimed in. 🤷♂️

How Consumers Use Online Reviews

As a financial advisor, it’s important to understand how the new SEC Marketing rule could affect you and your advisory business. Even if you don’t plan to ask for reviews or include reviews in your own marketing activities, you’ll need to be prepared to respond to questions from prospects and existing clients when they begin to see reviews appear online for other financial advisors.

While online reviews may be new to financial advisors, an evaluation of their impact on local businesses and professionals in other industries demonstrates why it’s imperative to begin preparing for a future where consumers are empowered to voice their opinions about you and your services.

The importance of online reviews on local businesses can be seen in numerous research reports conducted each year.

In an annual report prepared by BrightLocal based on a survey conducted in November 2020, 87% of consumers said they read online reviews for local businesses in 2020, up from 67% in 2010. The report indicated after reading a positive review for a local business, the next most likely actions are visiting the website of the business, searching for additional reviews to validate their choice and visiting the business in person.

And according to a research survey conducted in October 2020 by SurveyMonkey Audiences commissioned by Podium, among the 1,543 consumers surveyed, 88% said online reviews played a role in discovering a local business, 65% have read an online review in the last week and 41% said online reviews are 1 of the 3 most important factors they consider when choosing a local business.

Financial advisors interested in growing their practice should take note of these additional findings:

- 85% said employee attitude is the leading motivation to leave a positive review

- 58% of consumers said they would be willing to travel farther to a business with better reviews

- 47% are willing to pay more at a business with higher reviews

- Over 60% of consumers said they are likely to leave a review after a good experience with a local business when the business follows up with a link in an email asking for a review

As Emmy-winning writer David Pogue wrote about online review sites in Scientific American nearly 10 years ago, “No longer are you on top of the mountain, blasting your marketing message down to the masses through your megaphone. All of a sudden, the masses are conversing with one another. If your service or product isn’t any good, they’ll out you.”

How Wealthtender Compares

Wealthtender is the first independent financial advisor review platform designed to be fully-compliant with SEC regulations.

The SEC marketing rule served as the blueprint for building the Wealthtender review platform. Financial advisors can confidently collect and display reviews on their Wealthtender profile page with the required disclosures clearly and prominently displayed as prescribed by the SEC.

Unlike other review platforms, Wealthtender incorporates workflows for financial advisors to provide required disclosures which may be unique for each individual review. This ensures advisors can rest easy during SEC exams and sweeps when asked how reviews are used in their marketing activities.

To learn more about how Wealthtender compares to Google Reviews and other potential financial advisor review platforms, click here.

Online Reviews & Advisor Search Results

Will online reviews of financial advisors impact how prominently a financial advisor and their website appears in Google search results?

Very likely, the answer is yes, thanks to E-A-T and YMYL.

E-A-T And YMYL

E-A-T is a term used by Google that stands for Expertise, Authoritativeness and Trustworthiness as it pertains to the creator of website content. The term originates from a 175-page document used by human ‘Quality Raters’ to assess the quality of Google’s search results.

YMYL is another term defined by Google in the document as topics that could impact ‘Your Money or Your Life’. Specifically, Google states that “Some types of [web] pages or topics could potentially impact a person’s future happiness, health, financial stability, or safety. We call such pages “Your Money or Your Life” pages, or YMYL.”

Financial advisor websites are already subject to higher E-A-T and YMYL standards by Google than websites on topics of less importance to people’s lives.

When online reviews of financial advisors proliferate, Google’s guidelines for Quality Raters hint at the importance they’ll place on third party reviews over client reviews found directly on a financial advisor’s website. Specifically, Google states “you must also look for outside, independent reputation information about the website. When the website says one thing about itself, but reputable external sources disagree with what the website says, trust the external sources.”

By joining Wealthtender, financial advisors increase their E-A-T scores in the eyes of Google, strengthening their online reputation and improving their ranking in online search results.

Lessons for Advisors from Lawyers & Docs

For doctors and lawyers, online reviews have simply become a fact of life and requirement for conducting business. For financial advisors preparing for the new Investment Adviser Marketing rule, it’s worth considering insights gained about the role of online reviews across both professions.

What Financial Advisors Can Learn About Online Reviews From Doctors And Lawyers

With millions of reviews of doctors and lawyers, these sites often rank on the first page of Google results when consumers search for these professionals. In the BrightLocal consumer review survey, 89% of consumers said they look at reviews of medical professionals and 81% look at lawyer reviews. Over 80% of consumers said they believe reviews are important across both categories of professionals.

In 2018, an NRC Health Market Insights Study of over 3,000 patients showed that 37% used online reviews as their very first step in searching for a new doctor. And even when getting a recommendation from someone they trust, 21% then turned to online reviews to verify what they were told.

Additional findings included:

- 83% said they trust online ratings and reviews more than personal recommendations

- 48% trust online ratings and reviews as much as a recommendation from their doctor

- 75% want to see at least 7 ratings before they trust a doctor

- 66% consider reviews older than 18 months to be out of date

- 59% said positive and negative reviews are equally valuable to them

- 60% said they’re suspicious if they only see positive reviews for a doctor

In 2018, a Martindale-Avvo survey of 6,300 consumers asked the criteria that mattered most to them when choosing an attorney. When asked what information they desired before their first contact with an attorney, online reviews or client testimonials ranked 5th among 20 factors. The survey also noted consumers aged 25-35 gave greater weight to reviews and testimonials than consumers over age 54.

Additional consumer findings included:

- 47% used online review sites and directories to find an attorney (more than any other resource)

- 46% read online reviews of an attorney to conduct additional research after a personal referral

As Meranda Vieyra eloquently stated in The National Law Review, “The great thing about online reviews is that you have power to present your law firm and yourself with dignity and class, regardless of how good or bad your online reviews are.” For financial advisors preparing for the Investment Adviser Marketing rule, these words may prove prescient.

SEC Marketing Rule FAQs

Q: What is the effective date of the SEC Investment Adviser Marketing rule?

A: The SEC Investment Adviser Marketing rule became effective on May 4, 2021, 60 days after it was published in the Federal Register.

Q: What is the compliance deadline for the SEC Investment Adviser Marketing rule?

A: The compliance deadline for the SEC Investment Adviser Marketing rule is November 4, 2022, eighteen months after the May 4, 2021 effective date. (Source: Federal Register)

Q: What are SEC expectations for advisor reviews under the new rule?

A: Financial advisors who choose to include client reviews in their advertising under the new rule will need to work closely with their compliance officers to ensure they satisfy the SEC’s new disclosure and oversight requirements.

Key SEC expectations for advertisements featuring financial advisor reviews include:

– Clear and prominent disclosure indicating: If a review is from a client or non-client

– Whether or not the reviewer was compensated

– How the reviewer was compensated (in cash or otherwise)

– Any conflicts of interest (including a description of conflicts)

– A written agreement must be in place between a financial advisor and reviewer (unless the reviewer receives less than $1,000 for their review in cash or otherwise within a 12 month period)

The SEC also made it clear these requirements apply even if the review is a social media post like a tweet with a limited number of characters.

Q: Why can’t I find more financial advisor reviews on Yelp?

A: Since it’s a violation of Yelp’s terms of service for businesses to ‘solicit or ask for reviews’ from their customers, financial advisors are unable to encourage their clients to write a review on Yelp.

Q: Can financial advisors have Google Reviews?

A: Google and Yelp are well-known review platforms popular with consumers. And many advisors already have unsolicited reviews written about them visible on these sites. If these are favorable reviews and are truly unsolicited, that’s terrific as advisors gain SEO benefits and visibility among consumers visiting these sites.

But because reviews on Google and Yelp lack the required SEC disclosures to be considered advertisements (e.g. testimonials and endorsements you can promote to grow your business), advisors can’t direct prospects to check out their reviews on these platforms.

Online Reviews:

Wealthtender vs. Advisor Websites vs. Google & Yelp

Wealthtender is the first financial advisor review platform designed to be fully compliant with the SEC Marketing rule.

Learn how Certified Advisor Reviews™ from Wealthtender compare with other platforms in the comparison table below.

Additional Resources & FAQs

Can You Provide A Brief History of Financial Advisor Reviews?

In 1961, the year when John F. Kennedy became president of the United States, the SEC issued a rule prohibiting financial advisors from including client reviews when advertising their services. In fact, the rule concluded that an advertisement featuring a client review (referred to by the SEC as a ‘testimonial’) would “constitute a fraudulent, deceptive, or manipulative act, practice or course of business”.

Of course, the SEC deserves credit for the important role it plays protecting consumers from harm through its oversight of the financial services industry. And the prohibition of testimonials has certainly alleviated SEC concerns of financial advisors cherry picking 5-star reviews to promote their investment advisory services while burying 1-star reviews.

But this prohibition effectively silenced the voices of millions to a whisper over the past six decades whose opinions of their financial advisors were limited to cocktail parties while online reviews of professionals in other industries proliferated.

In 2019, the SEC acknowledged their 60-year old rule was doing consumers a disservice by not providing an opportunity for people to evaluate a financial advisor based on reviews as one factor in their hiring decision, in the same manner people research other professionals like doctors and lawyers online (not to mention mechanics, plumbers and babysitters).

What is the Investment Adviser Marketing Rule?

The Investment Adviser Marketing rule (more commonly referred to as the SEC Marketing Rule) allows financial advisors to provide investors with useful information to help them evaluate and choose investment advisers and advisory services, subject to conditions stipulated by the Securities and Exchange Commission (SEC) designed to prevent fraud.

In a press release issued on December 22, 2020 announcing its modernized marketing rule for financial advisors, the SEC acknowledged that technology and consumer expectations have changed dramatically since its decades-old advertising rule took effect.

According to SEC Chairman Jay Clayton, “The marketing rule reflects important updates to the traditional advertising and solicitation regimes, which have not been amended for decades, despite our evolving financial markets and technology.” He goes on to say the new rule “recognizes the increasing use of electronic media and mobile communications and will serve to improve the quality of information available to investors.”

While the Investment Adviser Marketing rule removes the severe limitations on financial advisor reviews, the SEC maintains its important role protecting consumers by requiring disclosures and conditions that must be met to ensure reviews are presented in a fair and balanced manner.

What Advice About Online Reviews Do Doctors and Lawyers Have for Financial Advisors?

We asked several doctors, lawyers and online review experts with experience in the medical and legal professions to offer their perspective for financial advisors preparing for the new SEC marketing rule. Here are a few of the highlights:

Max Meinerz, DDS

“Online reviews offer a way for you to invest some energy in generating a positive marketing message today that will be on the internet for minimally the length of your career.

Most patients and clients are happy to write you reviews and love the idea of sharing their chosen professional with others. You simply have to make a practice to ask and build a culture of referral inside of your organization.

Every compliment offered to you or any person on your team can be an invitation to ask for a review or referral. Responding in the moment is extremely important and making it very easy for clients to write that review by emailing/texting a link to your review page can assist in boosting reviews.

Make sure to spread your reviews across multiple platforms that are relevant to your industry. Only focusing on Google reviews can hurt you if Google chooses to change their search algorithm in a way that doesn’t jive with your SEO strategy.”

Jason Stern

“Online reviews are critical to any business in this digital age. As clients skew younger, they obtain nearly all of their information online. Online reviews provide multiple benefits, including marketing support, differentiation in a crowded market, business protection/insurance (positive reviews drowning out a negative review), pre-client meeting screening and validation.

Online review sites have helped me but they can also hurt your business if you don’t have an online review strategy as part of your marketing efforts.

Many of my clients have mentioned my reviews on Avvo [an attorney online review site] when hiring me so that is a positive.

Sites like Yelp are more mixed, especially since Yelp solicits advertising and punishes non-advertisers. As an example, I used to ask clients to write Yelp reviews and accumulated 10 to 15 five-star reviews.

At some point, Yelp asked me to advertise and when I declined, they buried ALL of my reviews under ‘Reviews NOT Recommended’ and they do not appear unless you scroll down and click on that link. It’s a common Yelp complaint from business owners and HARO founder Peter Shankman has commented and blogged about it in depth.”

Mrinalini “Melanie” Jayashankar

Attorney/Owner of the MJ Law Firm

“We are in the age of the internet. People make most decisions based on online reviews and recommendations. Therefore, having an exemplary online footprint with great online reviews is one of the best ways to grow your business.

Be proactive about online reviews and actively seek them out. The best way to get started is to start finding out about free directories and review websites for your profession. Claim your profile if applicable, and allow for online reviews. Start requesting reviews for multiple sites so that when people Google you, they will encounter multiple favorable reviews.

I always ask prospective clients to Google me and form their own opinions. My reviews speak for themselves, and most prospective clients feel more comfortable hiring me after seeing the multiple favorable reviews online. Have your online reviews work for you! Your former clients can sell you better than you can sell yourself!

I utilize both Avvo [an attorney online review site] and Google for reviews. I feel that both have positively impacted my practice. Most prospective clients comment that they looked me up online and were happy to see positive reviews. Online reviews also provide other benefits. You can share links to review sites on your website which can improve website traffic. Having multiple favorable Google rankings can potentially also improve your Google ranking in searches and general SEO performance.”

Kris Ruby

CEO, Ruby Media Group, KrisRuby.com

“Online reputation management is a burgeoning area in the new digital world where Google is now your new digital front door. What you say and what you post matters. And not posting and staying silent can also impact your reputation and damage trust. People expect instantaneous responses in a 24/7 connected digital world.

One thing I always tell doctors is to make sure they get online reviews the right way. This means don’t write fake reviews or have people try to write reviews who have never used your services. Navigating online reviews is challenging- it is why people hiring my agency, Ruby Media Group, to help them with this and have a consultant on retainer to craft these responses in real time in a way that mitigates risk and causes the least amount of harm. In addition to not causing harm, you also want to see if you can ’turn the tide’ to turn someone who is disgruntled into someone who can become an advocate. If people take the time to write a terrible review about your practice, they ultimately want to feel heard.

Step 1: Make them feel heard. Use their name when replying. “Hi X”

Step 2: Validate their feelings with true empathy. Strip the emotion out of what they are saying and objectively try to hear what the complaint is. Address it. Do not ignore it.

Step 3: Know when to stop. If you have tried every possible avenue to be accommodating to someone and they still continue to trash your business in every reply, a public thread of a business owner arguing is never a good look.

Online reviews have tremendous potential to impact your reputation, but ultimately, how you respond to the reviews has a greater impact. Respond with elegance in a way that is on brand for your company. People do not only measure a business by the negative reviews. Ultimately, they measure the business by the way the owner replies. Fundamentally, that is 50 % of the equation here, and the part that is unfortunately overlooked.

You as the practice owner have the power to help or hurt your online reputation. You have more power than you think and that starts with you and how you choose to handle difficult online situations.”

David Reischer, Esq.

Attorney & CEO of LegalAdvice.com

“My most important piece of advice to financial advisors fearful of online reviews is to work extremely hard to make sure they weed out potential bad reviews before they happen. I have been told by consumers at company trade shows that we attend that typically they just scan the attorney reviews looking for consistency among the reviews. If a pattern emerges for an attorney that is mostly negative then it is usually a good indicator of a problem.

Good reviews aren’t as important and valuable an indicator as bad reviews. Try to be proactive and preemptive to make sure a customer is satisfied before they post a negative review by asking a customer what can be done to make them happy and satisfied.”

What Does the SEC Say About Financial Advisor Ratings by Third Parties?

Under the new rule, financial advisors will be allowed to advertise ratings they receive from third party firms, subject to additional disclosures and conditions stipulated in the Investment Adviser Marketing rule.

In fact, the SEC states they anticipate approximately 50 percent of financial advisors will use third-party ratings in advertisements, so a proliferation of third party ratings of financial advisors may be on the horizon.

Key SEC expectations for advertisements featuring financial advisor ratings include:

- Clear and prominent disclosure indicating:

- The date on which the rating was given

- The period of time upon which the rating was based

- The identity of the third-party that created and tabulated the rating

- (If applicable) That compensation has been provided directly or indirectly by the financial advisor in connection with obtaining or using the third-party rating

- Financial advisors must have a reasonable basis for believing the questionnaire or survey used to prepare the rating meets certain criteria, including making it “equally easy for a participant to provide favorable and unfavorable responses”

- The firm publishing the rating can not be affiliated with the financial advisor and must be in the business of preparing ratings in their ordinary course of business

(These SEC expectations are summarized and don’t reflect all disclosure, oversight and disqualification provisions discussed in detail in the rule.)

I’m a financial advisor interested in joining Wealthtender. Where can I learn more?

Thanks for your interest in joining our community of financial advisors who know the power of digital marketing to attract their ideal client and grow their business. Learn more about Wealthtender and how you can get started today.

Financial advisors embracing online reviews will lead the industry in attracting new clients throughout the historic transfer of wealth from Baby Boomers to Millennials over the next decade.

– Brian Thorp, Wealthtender Founder and CEO